KATHMANDU: In the quest for economic advancement and social progress, the unveiling of the government’s 16th Five-Year Plan stands as a beacon of hope and strategic vision. With a focus on good governance, social justice, and economic prosperity, this plan charts a course towards transformative change.

Economically, the plan sets ambitious targets, aiming to elevate Nepal’s GDP and per capita income significantly.

Govt’s 16th Five-Year Plan aimed at driving economic growth, social progress

The government’s announcement of the 16th Five-Year Plan marks a significant moment for Nepal’s economic and social development. Spanning five years, starting from Shrawan, the plan delineates 40 national objectives centered on the pillars of good governance, social justice, and economic prosperity.

Economically, the plan sets forth ambitious targets, aiming to elevate Nepal’s GDP from USD 1,496 to USD 2,381 and boost per capita income from USD 1,410 to USD 2,413.

This signals a clear intent to propel the country towards higher growth trajectories, with an anticipated average growth rate of 6.6 percent and a targeted rate of 7.1 percent by the plan’s conclusion.

Beyond mere economic metrics, the plan represents a strategic blueprint for addressing multifaceted socio-economic challenges. It underscores the government’s recognition of the interconnectedness between governance reforms, social equity, and economic advancement.

By articulating a comprehensive vision, the plan lays the groundwork for inclusive development that reaches all segments of society.

However, realizing the aspirations outlined in the plan will demand concerted efforts and effective execution.

Nepal faces an array of obstacles, ranging from infrastructural deficiencies to institutional constraints, which must be navigated with diligence and resolve. Moreover, the plan’s success hinges on robust policy implementation, proactive management of uncertainties, and sustained commitment from all stakeholders.

Ultimately, the 16th Five-Year Plan signifies Nepal’s commitment to charting a path towards prosperity and progress. It represents not just a set of targets but a collective vision for a brighter future, underpinned by the principles of inclusivity, sustainability, and resilience. As the nation embarks on this journey, the challenges ahead may be formidable, but the potential rewards in terms of improved living standards and enhanced opportunities for all Nepalis are equally profound.

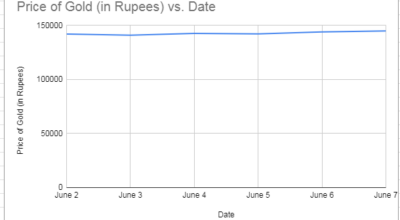

Gold prices witness volatility

Throughout last week, the price of gold exhibited a series of fluctuations, reflecting a complex interplay of economic indicators, geopolitical tensions, and investor sentiment. Commencing at Rs 142,000 per unit on 2nd June, gold experienced a marginal decline on 3rd June to Rs 141,000, possibly indicative of market corrections or shifts in demand-supply dynamics.

However, the following day saw a modest recovery, with prices rising to Rs 142,700, possibly driven by investor reactions to geopolitical events or macroeconomic indicators.

This trend was short-lived as gold witnessed a slight setback on 5th June, dropping to Rs 142,200 per unit, potentially influenced by adjustments in global commodity markets or currency fluctuations. Nevertheless, a notable surge occurred on 6th June, with prices reaching Rs 144,000, likely fueled by concerns over inflation, economic uncertainties, or safe-haven demand.

The week culminated with a further uptick in prices on 7th June, touching Rs 145,000 per unit, possibly driven by investors seeking refuge amid volatile equities or geopolitical tensions.

Looking ahead, factors such as inflationary pressures, central bank policies, and global trade dynamics will continue to shape gold prices, necessitating vigilant monitoring of economic indicators and geopolitical developments for informed investment decisions.

NEPSE rollercoaster: Market instability amid economic headwinds

The Nepal Stock Exchange (NEPSE) grappled with volatility and uncertainty throughout the week, underscoring the fragility of investor confidence amidst a backdrop of economic instability. Kicking off on 2nd June with a tepid uptick, the index edged up by a mere 13.51 points or 0.65%, offering little reassurance to wary investors.

This tentative optimism quickly evaporated on 3rd June as the index retreated, plunging by -3.97 points or -0.19%, signaling underlying weaknesses within the market. Despite fleeting moments of respite on 4th June, where the index clawed back with a nominal rise of 6.22 points or 0.29%, such gains proved ephemeral.

The following days witnessed a disheartening slide, exemplified by the index’s descent on 5th June to 2079.71, marking a disconcerting decline of -5.58 points or -0.26%. As the week drew to a close on 6th June, the NEPSE’s lackluster performance persisted, culminating in a marginal drop of -1.93 points or -0.09%, reflecting prevailing anxieties among investors.

Against a backdrop of economic uncertainty and global market volatilities, the NEPSE’s erratic trajectory underscores the imperative for investors to exercise caution and vigilance in navigating Nepal’s challenging investment landscape.

Forex exhibits notable fluctuations

The exchange rates fixed by the Nepal Rastra Bank (NRB) last week exhibited notable fluctuations across various currencies.

The week witnessed a dynamic forex market with varying trends across different currencies. The US dollar and Qatari riyal exhibited minor but noticeable fluctuations, while the Euro and British pound showed a more definitive upward trend towards the end of the week.

Starting with the US dollar, the rate showed a noticeable pattern. On June 5, the buying rate was set at NPR 133.36 and the selling rate at NPR 133.96. However, the rates fell back on June 8 to NPR 133.10 for buying and NPR 133.70 for selling, reflecting a volatile but generally stable trend.

The Euro experienced a slightly different trajectory. On June 5, the Euro’s buying rate was NPR 144.94 and the selling rate was NPR 145.59. These rates decreased on June 6 to NPR 144.59 and NPR 145.24, respectively.

The Euro showed a recovery and an upward trend after a slight drop mid-week.

The British pound’s exchange rate demonstrated consistent growth over the week. By June 8, the rates further increased to NPR 170.31 for buying and NPR 171.08 for selling, marking the highest values of the week.

The Qatari riyal saw minor fluctuations.

Finance Minister reassures timely completion of Nepal-MCC Project

Finance Minister Barshaman Pun’s assurance of the Nepal-MCC project’s timely completion reflects the government’s commitment to overcoming hurdles and ensuring successful execution. During discussions with MCC Vice President Jonathan Brooks, Minister Pun emphasized the critical cooperation necessary for the project’s culmination, highlighting the government’s proactive stance in addressing concerns such as land acquisition and forest area usage.

The reassurance from Minister Pun comes amidst bureaucratic delays and administrative hurdles that have hampered the timely initiation of the project, despite the agreement being inked in 2017. Despite these challenges, Minister Pun’s proactive approach signals a determination to overcome obstacles and propel the project forward.

Vice President Brooks expressed satisfaction with the progress made thus far, particularly noting advancements in the construction of electricity transmission lines and roads.

The 60 billion rupees MCC agreement, which includes the construction of 315km of transmission lines and 77km of roads within a five-year timeframe, underscores the magnitude of the project and its significance for Nepal’s infrastructure development.

While hurdles remain, Minister Pun’s reassurance underscores the government’s commitment to fulfilling its obligations and leveraging external investments for national development. With continued cooperation and proactive measures, the Nepal-MCC project holds the potential to significantly enhance the country’s infrastructure and economic prospects in the years to come.

Nepal unveils anti-money laundering strategy amid grey-listing threat

In response to the looming threat of greylisting by the Financial Action Task Force (FATF), the Ministry of Finance has launched a comprehensive five-year strategy aimed at combatting money laundering.

Spearheaded by Finance Minister Barshaman Pun, the strategy, titled ‘National Strategy and Work Plan on Prevention of Financial Investment in Money Laundering and Terrorist Activities,’ is slated to commence implementation in the upcoming fiscal year, pending approval from the Cabinet.

This strategic move comes on the heels of a sobering Mutual Evaluation Report by the Asia Pacific Group on Money Laundering, which underscored significant legal deficiencies within Nepal’s financial system and sounded the alarm on the potential consequences of inaction, including the peril of greylisting.

This initiative represents a proactive effort by the government to shore up regulatory frameworks and bolster enforcement mechanisms in order to mitigate systemic vulnerabilities and safeguard the integrity of Nepal’s financial sector.

However, the efficacy of this strategy hinges on its swift and robust implementation, as well as sustained commitment from relevant stakeholders, amidst the formidable challenge of navigating bureaucratic hurdles and entrenched interests.

NTA revokes CG Communications license over renewal failure

The revocation of CG Communications Limited’s license by the Nepal Telecommunication Authority (NTA), owned by Binod Chaudhary, due to its failure to renew within the stipulated timeframe, highlights the stringent regulatory environment in Nepal’s telecommunications sector.

This decision was triggered by CG’s inability to submit the required application and fee on time, despite expressing intentions to continue services post-license expiry.

This regulatory action underscores the importance of compliance with regulatory obligations to ensure the continuity of services within the telecommunications industry. It signals the NTA’s commitment to enforcing compliance and maintaining the integrity of the sector through measures such as the automatic cancellation provision in the Telecommunications Regulations.

The impact of this decision extends beyond CG Communications Limited, raising concerns about the potential disruptions or uncertainties in services experienced by customers reliant on CG’s telecommunications offerings. It emphasizes the broader implications of regulatory compliance not only for companies but also for consumers and the overall telecommunications ecosystem.

Furthermore, the issuance of a public notice to CG Communications Limited in Sanepa regarding the license cancellation demonstrates a transparent communication approach by the NTA. This ensures that stakeholders are informed about regulatory decisions, promoting transparency and accountability within the industry.

Overall, this development highlights the critical importance of regulatory compliance and adherence to licensing requirements for telecommunications companies operating in Nepal. It serves as a reminder of the consequences of non-compliance and the necessity for robust regulatory mechanisms to uphold the stability and integrity of the telecommunications sector.

IMF raises concerns over Nepal’s economic reform progress

The IMF has expressed concern over Nepal’s slow progress in crucial economic and financial reforms, noted during a recent visit led by Tidian Kinda, deputy division chief of the IMF’s Asia-Pacific Department.

The IMF highlighted areas lacking progress, stressing amendments to the Nepal Rastra Bank (NRB) Act and advocating for international audits of bank credits and independent audits of the NRB.

The IMF urged granting autonomy to the NRB, transparency in budget utilization, and better financial risk assessment. Collaborating with the IMF, Nepal aims to enhance reform effectiveness, focusing on revenue mobilization, capital expenditure, and financial transparency strategies.

Despite global uncertainties like COVID-19, Nepal continues to receive IMF financial assistance through the Extended Credit Facility (ECF), emphasizing the importance of prudent financial management.

(Prepared by Srija Khanal)

Comment