KATHMANDU: The fluctuating trends of gold prices throughout the week underscore the volatility inherent in the precious metals market. Starting at Rs 142,000 per tola, prices saw daily fluctuations influenced by global economic cues and market sentiments.

Meanwhile, NEPSE (Nepal Stock Exchange) index demonstrated a week of varied movements, reflecting investor sentiment and external economic factors. Despite initial gains, the index experienced fluctuations, emphasizing its sensitivity to global economic conditions and local policy developments.

Similarly, Nepal’s trade deficit has widened significantly to Rs 1.3 trillion, driven by heavy reliance on imports which far exceed exports. This imbalance underscores the challenges in stimulating local industries and boosting exports despite efforts such as subsidies for cement.

Additionally, Nepal Rastra Bank’s initiative to implement market conduct supervision aims to safeguard consumers from financial risks associated with financial products and services. This regulatory framework is intended to ensure adherence to market standards while encouraging responsible lending to stimulate domestic production.

The fluctuations in gold prices and the NEPSE index reflect a volatile economic environment, while the widening trade deficit underscores the country’s import dependence.

The regulatory measures by Nepal Rastra Bank aim to mitigate risks and stimulate economic growth, emphasizing the need for balanced economic policies and enhanced trade relationships to address these challenges effectively.

NEPSE index sees weekly fluctuations amid global economic uncertainty

The NEPSE (Nepal Stock Exchange) index witnessed a week of fluctuating movements, reflecting diverse investor sentiments and external economic influences. Beginning at 2062.94 points on June 23 (Sunday), the index registered a modest decline of -5.37 points or -0.25%.

This trend reversed on June 24 (Monday) with a gain to 2066.16 points, marking an increase of 3.21 points or 0.15%. Continuing this upward trajectory, June 25 (Tuesday) saw the index climb further to 2071.77 points, up by 5.60 points or 0.27%.

However, market volatility emerged mid-week on June 26 (Wednesday) as the index sharply dropped to 2060.16 points, reflecting a decline of -11.60 points or -0.56%. This downward trend persisted on June 27 (Thursday) with the index closing at 2051.92 points, down by -8.24 points or -0.4% from the previous day.

These movements underscored the market’s sensitivity to global economic conditions, local policy developments, and investor confidence.

Meanwhile, the NEPSE index yesterday (Sunday) dropped by 14.83 points.

The stock market fell to 2037.09 points on the first trading day of the week.

During Sunday’s trading session, the share prices of 190 companies declined, while only 49 companies saw an increase in their share prices.

Seven companies experienced no change in their share prices.

A total of 9,178,895 shares, amounting to Rs 3.60 billion (NPR 3,607,198,407) were traded on Sunday.

Muktinath Agricultural Company investors saw the highest gains, while investors in Manakamana Smart Microfinance Financial Institution experienced the most significant losses on the first trading day of the week.

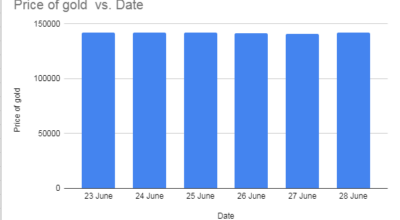

Gold prices in Nepal fluctuate throughout the week

Throughout the week, the price of gold in Nepal exhibited fluctuating trends. Starting the week at Rs 142,000 per tola on June 23 (Sunday), prices saw a minor increase to Rs 142,300 on June 24 (Monday) and remained stable on June 25 (Tuesday). However, by June 26 (Wednesday), there was a notable decrease to Rs 141,600 per tola, indicating a 0.49% drop from the previous day.

This decline continued on June 27 (Thursday) with prices falling further to Rs 140,800 per tola, marking a 0.56% decrease. Towards the end of the week, on June 28 (Friday), gold prices rebounded to Rs 141,800 per tola, a 0.71% increase from the previous day.

The week’s performance reflects varying market sentiments influenced by global economic cues, including shifts in demand, geopolitical developments, and currency movements. These fluctuations underscore the volatility inherent in the precious metals market, impacting both investors and consumers alike in Nepal’s economic landscape.

Nepal’s trade deficit widens to Rs 1.3 trillion amid heavy import dependence

Nepal’s trade deficit has soared to Rs 1.3 trillion, largely driven by heavy reliance on foreign imports, including goods that could be domestically manufactured. Imports for the current fiscal year have totaled Rs 1.454 trillion, far exceeding exports which stood at Rs 139.26 billion, resulting in a significant deficit.

Trade with India dominates, with imports amounting to Rs 982.9 billion compared to exports of Rs 94.51 billion. Efforts to stimulate exports, such as subsidies for cement, aim to bolster local industries but face hurdles amidst declining export figures.

Nepal is actively pursuing strategies to diversify its trade relationships and enhance domestic production capabilities in order to rectify its economic imbalance.

NRB prepares market conduct supervision to safeguard consumers and stimulate lending

Nepal Rastra Bank (NRB) plans to implement market conduct supervision starting from the upcoming fiscal year, aiming to protect consumers from potential risks associated with financial products and services. NRB Governor Maha Prasad Adhikari underscored the necessity for robust measures to safeguard consumers against irregularities in financial services.

The new supervision framework will prioritize monitoring industry dynamics, evaluating the operational practices of financial institutions, and ensuring adherence to market conduct standards.

Adhikari also addressed concerns regarding the banking sector’s cautious approach towards lending despite sufficient liquidity, emphasizing the importance of targeted lending to stimulate domestic production.

Looking forward, he advocated for a data-driven approach in formulating the monetary policy for the next fiscal year, underscoring NRB’s commitment to addressing challenges encountered by the private sector and strengthening coordination with fiscal policies.

NEA completes over a dozen substations and distribution systems in one year

The Nepal Electricity Authority (NEA) has prioritized the construction of high-capacity transmission line projects across the country during fiscal year 2080/81 BS.

Key achievements include the completion of 400 kV, 220 kV, and 132 kV transmission lines spanning various regions. The NEA has also focused on building substations to enhance the country’s electrical infrastructure.

Highlights include the 220 kV Kaligandaki Corridor transmission line, stretching 130 kilometers from Dana substation in Myagdi to New Butwal substation in Nawalparasi. Additionally, the NEA has finished the first circuit of the 220 kV Basantapur-Dhungesanghu line under the Koshi Corridor project.

Furthermore, an 88-kilometer 220 kV transmission line from Marki Chowk to Matatirtha substation in Kathmandu, along with a corresponding substation, has been completed within the same fiscal year.

Govt aims to manage public debt in line with 16th periodic plan targets

Finance Minister Barshaman Pun stated that the government intends to manage public debt in accordance with targets outlined in the 16th periodic plan. He highlighted that Nepal’s public debt now stands at 42.08% of the GDP. Speaking at a House of Representatives meeting, Pun emphasized the government’s enhanced capability to repay borrowed funds.

He noted that domestic borrowing aligns with guidance from the National Natural Resources and Fiscal Commission. As of mid-June 2024, Nepal’s debt has risen to Rs 2.434 trillion from Rs 2.299 trillion in mid-July 2023.

The National Statistics Office projects the country’s GDP to reach Rs 5.748 trillion by the end of this fiscal year.

NOC increases petroleum product prices

The Nepal Oil Corporation (NOC) announced an upward revision in the prices of petroleum products following a Board of Directors meeting held on Sunday.

Effective immediately, the price adjustments reflect increases of Rs 2 per liter for petrol and Rs 5 per liter for diesel and kerosene. This decision comes in response to the recent rise in prices by the Indian Oil Corporation, which influences pricing in Nepal.

As a result, in Kathmandu, petrol is now priced at Rs 167 per liter, while diesel stands at Rs 157 per liter. The prices for aviation fuel and LP gas will remain unchanged, according to the corporation’s announcement.

The price adjustments are expected to impact consumers and various sectors, with potential implications for inflation and economic activity.

(Prepared by Srija Khanal)

Comment