KATHMANDU: The Financial Intelligence Unit (FIU) under Nepal Rastra Bank has made public its 14th annual report for the fiscal year 2081/82 (2024/25), highlighting significant progress in efforts to control money laundering and financial crimes in Nepal.

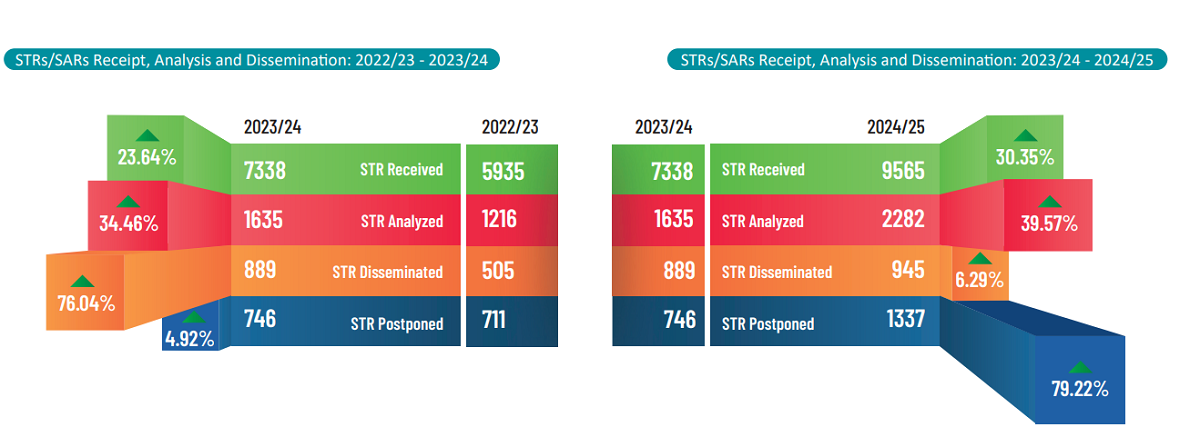

According to the report, the number of Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs) received from financial institutions increased by 30 percent during the review period. While 7,338 such reports were received in the previous fiscal year, the number rose to 9,565 this year. The increase indicates heightened vigilance within the financial sector and a strengthening of monitoring mechanisms.

The FIU has fully digitized the reporting of all suspicious transactions. The report states that the number of reporting entities connected to the goAML system increased by 113.36 percent, reaching 3,497 institutions. Notable progress has been achieved in integrating cooperatives, precious metals traders, and remittance companies into the system.

The report also seriously addresses Nepal’s inclusion in the Financial Action Task Force (FATF) grey list in February 2025. Nepal has agreed to a two-year action plan to address identified strategic deficiencies. To exit the grey list, the FIU has committed to further strengthening a risk-based approach, expanding the use of technology, and enhancing coordination among regulatory agencies.

The FIU’s analysis identifies revenue evasion, banking fraud, currency and banking-related offenses, and money laundering through hundi and cryptocurrency as major financial crime risks in Nepal. During the review period, the unit forwarded 945 financial intelligence reports to law enforcement agencies, including Nepal Police and the Department of Revenue Investigation, for further investigation.

Considering the rise in digital crimes and increasingly complex financial structures, the FIU plans to adopt advanced technologies such as artificial intelligence and machine learning. The unit believes these tools will help analyze large volumes of data and identify hidden financial networks more effectively.

FIU Chief Basudev Bhattarai, in the report, emphasized that cooperation among all concerned stakeholders is essential to safeguard the integrity of Nepal’s financial system and ensure compliance with international standards.

Comment