KATHMANDU: In the fiscal year 2023/24, Nepal experienced an annual average inflation rate of 5.44%, which was within the target ceiling and slightly higher than previous years.

The Rastra Bank’s report highlights a modest decrease in both imports (down 1.2%) and exports (down 3%) compared to the previous fiscal year, suggesting some stabilization in trade.

Remittance inflows increased by 16.5% to NPR 1,445.32 billion, though this was slower than the previous year’s growth.

The balance of payments improved significantly with a surplus of NPR 502.49 billion, and foreign exchange reserves reached USD 15.27 billion.

Monetary aggregates showed a 13.0% growth in broad money and deposits, while private sector credit rose by 5.8%.

Gold prices in Nepal exhibited volatility, peaking mid-week before declining, reflecting market sensitivities.

The Nepse index saw a generally positive trend with minor fluctuations, indicating investor confidence.

Construction of the Gautam Buddha International Cricket Stadium in Bharatpur has resumed, with a completion target set for January 2027.

Nepal’s electricity transmission network has expanded significantly to 6,507 circuit kilometers. In the first month of FY 2024/25, government revenue doubled expenditure, with revenue reaching NPR 96.95 billion.

Additionally, the NEA extended the national grid to Gosainkunda, improving electricity access in this remote area.

Nepal witnesses 5.44% annual average inflation in 2023/24

Nepal’s inflation rate for the fiscal year 2023/24 was reported at 5.44 percent, aligning closely with the expected target ceiling. This figure represents a moderate increase compared to previous years but remains manageable within the anticipated economic framework.

According to the latest “Current Macroeconomic and Financial Situation of Nepal” report by the Rastra Bank, Nepal experienced a decrease in both imports and exports over the past year.

Imports fell by 1.2 percent and exports by 3 percent. This decline is markedly less severe than the previous fiscal year, when imports had plummeted by 16.1 percent and exports by 21.4 percent.

This reduced contraction suggests some stabilization in trade flows compared to the previous year’s dramatic downturn.

Remittance inflows robust, rising by 16.5 percent

Remittance inflows have been notably robust, rising by 16.5 percent to Rs. 1,445.32 billion last fiscal year.

Although this growth was slower compared to the 23.2 percent increase in the prior year, it remains a vital component of Nepal’s economy.

When converted to U.S. dollars, remittances grew by 14.5 percent to $10.86 billion, reflecting a slight acceleration from the 13.9 percent rise seen in the previous year.

The balance of payments showed significant improvement, recording a surplus of Rs. 502.49 billion, up from Rs. 285.82 billion the previous year.

This indicates a stronger overall financial position and a more favorable external account balance.

Gross foreign exchange reserves reach USD 15.27 billion

Nepal’s gross foreign exchange reserves reached USD 15.27 billion, providing a comfortable buffer to cover imports of merchandise and services for approximately 13 months.

This level of reserves suggests a solid position to manage external shocks and support economic stability.

In terms of monetary aggregates, broad money (M2) grew by 13.0 percent, and deposits at Banks and Financial Institutions (BFIs) also increased by 13.0 percent. Private sector credit saw a more modest rise of 5.8 percent. Total deposits at BFIs amounted to Rs. 6,452 billion, while private sector credit stood at Rs. 5,074 billion.

Overall, while inflation in Nepal remained within the target range, the economic indicators point to a period of cautious stabilization with modest improvements in trade and financial metrics, balanced against a slightly slower pace in remittance growth and credit expansion.

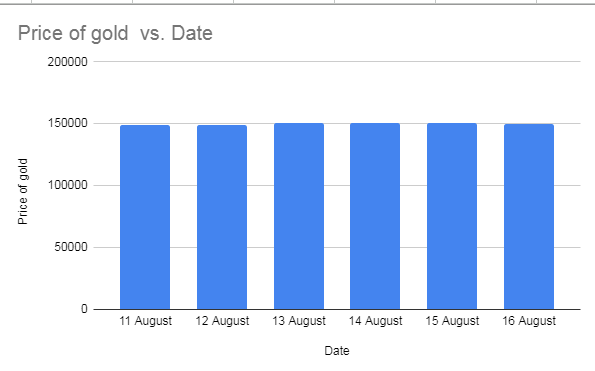

Gold prices in Nepal show volatility with mid-week spike and end-of-week decline

Throughout the week of August 11 to August 16, 2024, the gold price in Nepal exhibited notable fluctuations.

Starting at Rs 148,800 on Sunday, the price experienced a slight decrease to Rs 148,700 on Monday.

However, a sharp increase was observed on Tuesday, with the price rising to Rs 150,800. This upward trend persisted through Wednesday and Thursday, stabilizing at Rs 150,500. On Friday, the price fell back to Rs 149,600.

This week’s data suggests a volatile market with a significant mid-week spike, followed by a decline towards the end of the week.

The fluctuation could be attributed to various factors including market demand, geopolitical influences, or domestic economic conditions.

The overall pattern indicates a tendency for gold prices to be sensitive to short-term market dynamics, reflecting the broader economic uncertainties impacting precious metal investments.

Nepse index sees upward trend with minor mid-week dip

During the week of August 11 to August 15, 2024, the Nepse index demonstrated notable volatility, reflecting dynamic market conditions. On Sunday, the index surged by 3.41% to 2860.84, with an absolute increase of 94.46 points.

This upward momentum continued into Monday, as the index climbed to 2931.65, marking a 2.4% rise with a 70.81-point gain.

However, the positive trend encountered a minor setback on Tuesday, with the index slightly falling by 0.27% to 2923.46, a decrease of 8.18 points.

The market rebounded on Wednesday, advancing to 2957.75, which represented a 1.17% increase and a 34.29-point rise.

The upward trajectory persisted on Thursday, as the index reached 3000.81, a significant 1.45% gain with an absolute change of 43.05 points.

This week’s performance reflects a generally bullish sentiment despite a brief dip, indicating investor confidence and potentially favorable market conditions driving the index higher.

Bharatpur resumes Gautam Buddha International Cricket Stadium construction

Bharatpur Metropolitan City has resumed construction of the Gautam Buddha International Cricket Stadium, with coordinated efforts from both provincial and central governments.

The current phase involves stone soling beneath the parapet, and local materials and reinforcing rods are undergoing laboratory tests to ensure quality.

Mayor Renu Dahal has emphasized the importance of timely project completion and committed to providing necessary support.

Engineer Jagannath Aryal has detailed that the stadium will accommodate 10,000 spectators, with an overall construction budget of Rs 755.5 million. Funding for the project includes Rs 250 million from the federal budget and Rs 40 million from local resources, with Bagmati Province covering 70% of the total costs.

The Dhurmus Suntali Foundation has already completed the parapet, which includes 5,000 seats and 286 pillars. The stadium is scheduled to be finished by January 6, 2027.

Nepal doubles electricity transmission network to 6,507 km despite challenges

Nepal has significantly expanded its electricity transmission infrastructure, with the total length of transmission lines now reaching 6,507 circuit kilometers—more than double the extent from eight years ago. As of FY 2015/16, the network covered 2,911 circuit kilometers.

NEA Managing Director Kulman Ghising emphasized the substantial progress achieved despite obstacles such as local resistance, land acquisition issues, and challenges in transporting materials. The current transmission network comprises 4,136 km of 132 kV lines, 1,213 km of 220 kV lines, 644 km of 400 kV lines, and 514 km of 66 kV lines.

Government’s revenue in first month of FY 2024/25 doubles expenditure

In the first month of fiscal year 2024/25, the government’s revenue collection significantly outpaced its expenditures.

According to the Financial Comptroller General Office (FCGO), revenue totaled Rs 96.95 billion from mid-July to mid-August, doubling the expenditure of Rs 40.20 billion. Expenditure for the period constituted only 2.16% of the annual target, while revenue collection reached 6.59% of its annual goal.

Of the expenditures, Rs 12.38 billion (1.09%) was for recurrent costs, Rs 8.55 billion (2.43%) for capital expenses, and Rs 19.27 billion for debt servicing.

For the fiscal year, the government has set aside Rs 1.140 trillion for recurrent expenditure, Rs 352.35 billion for capital expenses, and Rs 367.28 billion for financial management.

NEA extends national grid power to Gosainkunda

For the first time, Gosainkunda, the renowned holy site in Rasuwa district, Bagmati province, has received electricity from the national transmission line. This development is expected to enhance the convenience for pilgrims visiting the site.

The Nepal Electricity Authority (NEA) has achieved this milestone as part of its ongoing effort to bring electricity to remote areas.

The new power supply, operational since Friday evening, is a significant improvement over the previous reliance on solar lights.

Situated at an elevation of 4,380 meters, Gosainkunda now enjoys a well-lit environment, especially during the Janai Purnima festival.

The project involved installing a 15-KVA distribution transformer to extend power up to Gosainkunda, located about eight kilometers from Chandanbari, and cost approximately Rs 30 million.

Nepal’s Current Macroeconomic and Financial Situation

The Nepal Rastra Bank (NRB) unveiled the “Current Macroeconomic and Financial Situation of Nepal”.

Nepal’s economy experienced mixed trends in the fiscal year 2023/24, according to data released by the Nepal Rastra Bank’s Economic Research Department.

The report highlights key macroeconomic and financial developments, shedding light on the country’s economic health.

The annual average inflation rate stood at 5.44 percent, indicating a moderate rise in the cost of goods and services.

In the external sector, both imports and exports saw a decline of 1.2 percent and 3.0 percent, respectively.

This follows a more significant drop in the previous fiscal year, where imports decreased by 16.1 percent and exports by 21.4 percent.

On a positive note, remittances, a vital source of income for many Nepalese households, increased by 16.5 percent in Nepalese rupees and 14.5 percent in USD.

This surge in remittances has contributed to a stronger Balance of Payments (BoP), which recorded a surplus of Rs. 502.49 billion, up from Rs. 285.82 billion in the previous year.

Nepal’s gross foreign exchange reserves reached USD 15.27 billion, sufficient to cover 13 months of merchandise and services imports, ensuring the country’s external stability.

The financial sector also saw positive growth, with broad money (M2) expanding by 13.0 percent.

Deposits at Banks and Financial Institutions (BFIs) grew by 13.0 percent, bringing total deposits to Rs. 6452 billion.

Meanwhile, private sector credit increased by 5.8 percent, amounting to Rs. 5074 billion.

These figures reflect a resilient yet cautious economic environment in Nepal as the country navigates through global and domestic challenges.

(Prepared by Srija Khanal)

Comment