The issue of inter-agency correlation stands pivotal in understanding why the objectives outlined in the budget remain unfulfilled.

While we articulate monetary and financial policies aimed at bolstering the economy, their implementation often falls short.

Effective action demands a collaborative effort. It necessitates convening at the nexus of the Central Bank and the Ministry of Finance, with active involvement from stakeholders.

Success hinges on fostering a conducive environment through stakeholder engagement.

Business communities, civil society, the Nepal Rastra Bank governor, and the Ministry of Finance collectively shape our economic trajectory.

In navigating these complexities, collaboration between finance and monetary authorities emerges as an indispensable strategy.

Reflecting on our economic landscape, it’s evident that our growth aspirations are yet to materialize.

Despite modest progress, such as a 3.87 percent growth rate compared to the previous year’s 1.95 percent, we fall short of benchmarks set by neighboring nations like India and global economic leaders like the United States.

Monetary policy emerges as a bright spot amidst these challenges, with notable savings and controlled inflation.

However, the dearth of capital expenditure casts a shadow over our economic prospects, underscoring the need for balanced policy intervention.

Drawing a cautionary tale from history, we recognize that excessive intervention, akin to excessive bleeding in medical treatment, can exacerbate rather than alleviate economic woes.

Prudent decision-making must precede policy interventions, recognizing the delicate balance required to steer the economy.

With a semblance of stability emerging in monetary policy, aligning it with financial policy becomes imperative, focusing on resource mobilization within the market.

While incremental progress is evident, our revenue mobilization efforts remain lackluster, compounded by challenges in securing foreign aid.

Addressing these fiscal constraints demands innovative solutions and a proactive approach to revenue diversification.

In navigating these complexities, collaboration between finance and monetary authorities emerges as an indispensable strategy.

By aligning policy actions and fostering synergy among stakeholders, we can chart a more resilient and prosperous economic path.

It’s been observed that our stringent policies have inadvertently fueled theft and revenue leakage.

However, quantifying their exact impact remains elusive amidst a complex web of contributing factors.

What’s evident is the imperative to broaden our revenue base, recognizing that systems evolve over time.

Reflecting on past successes, such as the successful imposition of Value Added Tax (VAT), underscores the need for adaptability.

Just as a vehicle requires replacement after two decades of service, our fiscal mechanisms demand periodic overhaul.

As we chart a path forward, comprehensive economic diagnostics become paramount.

The Statistics Office’s expanded scrutiny across 19 sectors promises a more holistic assessment, ranging from agriculture to tourism, facilitating informed decision-making.

Breaking free from the cycle of stagnant capacity necessitates a shift in budgetary approach.

Rather than dispersing resources thinly, a focused, ruthlessly efficient strategy is warranted.

While certain sectors may thrive, equitable development mandates attention to areas lagging behind.

Comparisons with other nations reveal valuable insights, yet blind replication risks discordance with our unique economic context.

Just as mismatched blood types elicit adverse reactions, borrowed practices may prove incompatible. Thus, tailored solutions attuned to our national exigencies are imperative.

A proactive stance promises manifold benefits, including job creation and increased tax revenues, fostering a symbiotic relationship between policy actions and economic outcomes.

With a semblance of stability emerging in monetary policy, aligning it with financial policy becomes imperative, focusing on resource mobilization within the market.

A substantial sum of 6 trillion rupees lies idle in banks, prompting a dialogue with bankers regarding potential avenues for utilization, spanning counter-cyclical buffers and other capital investments.

Building trust is paramount to market dynamics, as risk appetite correlates with confidence levels.

Investors seek returns commensurate with perceived risks, necessitating concerted efforts to bolster trust and incentivize investment.

India’s robust credit growth, standing at 16 percent for consecutive years, serves as a benchmark, underscoring the potential for accelerated growth.

Despite past disparities between credit expansion and economic growth, recalibrating policies can bridge this gap.

A collective endeavor to achieve an average growth rate of 10/12 percent warrants immediate attention, especially with the fiscal year drawing to a close.

Discussions within the Central Bank Board emphasize the collective pursuit of national interests over personal agendas.

A proactive stance promises manifold benefits, including job creation and increased tax revenues, fostering a symbiotic relationship between policy actions and economic outcomes.

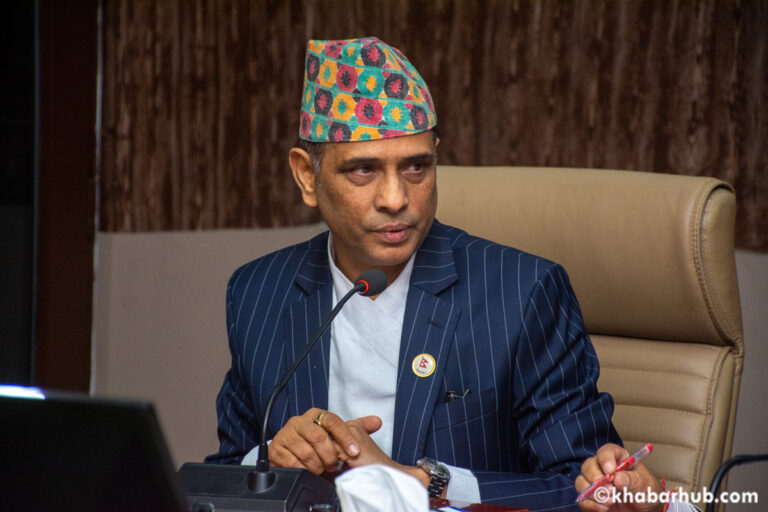

(Edited excerpt of views expressed by Finance Secretary Madhu Marasaini at an interaction program on ‘Coherence between Monetary Policy and Fiscal Policy’ organized by Khabarhub and Institute for Strategic and Socio-Economic Research (ISSR)

Comment