KATHMANDU: The enigma surrounding the Ncell case has captured the public’s curiosity, delving into the intricate details of the apparent shift in ownership.

Before we explore the depths of Ncell’s tumultuous journey, let’s scrutinize the crucial 6-page ‘share purchase agreement’ inked between Malaysian conglomerate Axiata and Singaporean citizen Satishlal Acharya on December 1.

Axiata previously held an 80 percent stake in Ncell, securing a telecommunications license from the Nepal Telecommunication Authority on September 1, 2004, to operate private telephone services for 25 years.

The remaining 20 percent rested with Sonevera, a company owned by Satishlal Acharya’s wife, Bhawana.

However, Acharya’s acquisition of Axiata’s 80 percent shares on December 1 has sparked suspicions.

The profit distribution plan stipulates Acharya paying 80 percent in 2023, followed by 40 percent in 2024 and 2025, and 30 percent in 2026 and 2027.

A closer look at the purchase agreement raises questions about whether Axiata genuinely sold its shares or merely deceived and manipulated the Nepalese government.

Here are some critical inquiries:

First question: Seven years ago, Axiata acquired 80 percent of Ncell’s shares for $1.315 million.

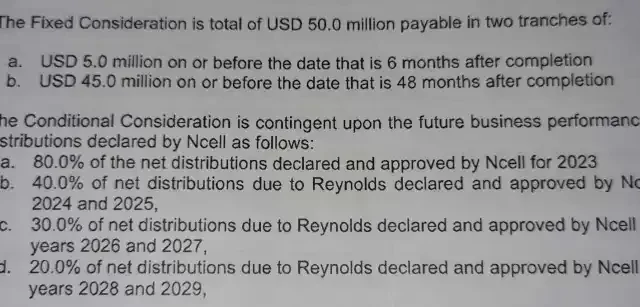

The contract now states that Axiata sold these shares to Acharya for only $50 million.

Such a substantial decrease in value prompts skepticism, casting doubts on the authenticity of the sale.

Second question: The agreement reveals that Axiata, the seller of Ncell’s shares, will continue to reap profits until 2029, even after receiving $50 million from Acharya.

This ongoing profit-sharing arrangement contradicts the notion of a conventional share sale, fueling suspicions about Axiata’s true exit strategy.

Axiata is set to receive $50 million within six months and an additional $45 million by 2027, along with a share of Ncell’s profits until 2029.

The acquisition of 80 percent of Ncell’s shares from the Malaysian company Reynolds Holding was executed through this newly formed foreign entity, raising questions about the nature of the investment.

The profit distribution plan stipulates Acharya paying 80 percent in 2023, followed by 40 percent in 2024 and 2025, and 30 percent in 2026 and 2027.

Even in the years 2028 and 2029, when Ncell’s license expires, Axiata is entitled to 20 percent of the profits.

The persistence of profit-sharing questions the legitimacy of the proclaimed share sale.

Third question: Ncell, being a company with over 50 percent foreign investment, faces automatic nationalization under Nepalese laws and bilateral agreements after the license period expires.

Section 33 of the Telecommunications Act asserts that such companies will be government-owned.

With Ncell’s license expiring on September 2, 2029, the looming question is whether Satishlal Acharya’s attempt to portray more than 50 percent Nepalese ownership can circumvent government control.

The government’s response to Axiata’s share sale and its subsequent decision on license renewal or revocation adds another layer of intrigue to this unfolding narrative.

Fourth question: Does Ncell currently have 100% foreign investment?

Satishlal Acharya, a Singaporean citizen of Nepali origin, recently acquired 80 percent of Ncell’s shares through his foreign company.

While this transaction constitutes foreign investment, the remaining 20 percent is owned by his family company,

Sunivera Capital Ventures. The question arises: is this 20 percent considered indigenous or foreign investment?

In this context, Acharya’s current ownership structure prompts a critical inquiry—does Acharya now hold 100% foreign investment in Ncell?

If so, operating Ncell with full foreign investment would contravene Nepal’s legal framework.

The juxtaposition of a foreign-owned husband’s company and a domestically owned wife’s company raises doubts and challenges belief.

Ncell, a pioneer in Nepal’s private mobile services sector, marked its trademark registration on July 1, 2004.

With a certificate number 23022, the company initiated telephone service operations the following year. Over the past 18 years, Ncell has consistently maintained profitability.

The recent agreement on December 1, 2023, involving the purchase and sale of Ncell shares occurred between ‘Spectralite UK Limited’ and Axiata UK Limited.

Acharya, the mastermind behind SpectraLite UK, is a Singaporean businessman, with records in the company registrar’s office indicating his address in Kathmandu, Nepal.

Acharya, in September of the same year, established Spectralite UK with a nominal capital of one British pound and a paid-up capital of only $1.

Seven years ago, Axiata purchased 80 percent of Ncell’s shares, now owned by Satishlal Acharya, from Telesonera for 1.43 billion rupees (1.335 million US dollars at the time).

The acquisition of 80 percent of Ncell’s shares from the Malaysian company Reynolds Holding was executed through this newly formed foreign entity, raising questions about the nature of the investment.

Satishlal’s family, closely affiliated with Ncell since its inception, initially held a 20 percent stake.

Presently, Satishlal exclusively owns 100% of Ncell. Through their family company, Sunivera Capital Ventures, they maintain a 20 percent ownership in Ncell.

Notably, the entirety of Ncell’s shares, comprising 20 percent indigenous and 80 percent foreign ownership, is consolidated within the family.

Despite Satish being a foreign citizen, intriguingly, it is asserted that his brother, Sachin Lal, and Bhawana Singh Shrestha, residing in Singapore, are considered Nepali.

This classification forms the basis for attributing 20 percent of the shares to domestic ownership.

The investment paradoxically appears to straddle both domestic and foreign categories, despite being rooted in the same family entity. An intriguing aspect indeed!

Former king’s son-in-law and Ajay Sumargi’s ‘connection’

Ncell, established as the first private telecom service challenging the government-owned Nepal Telecom, commenced operations during the reign of the then King Gyanendra Shah.

In the era of King Gyanendra, Raj Bahadur Singh, his son-in-law, and businessman Ajay Sumargi obtained golden shares from Ncell through negotiations with leaders.

By subsequently selling these shares, Sumargi and Raj Bahadur experienced an overnight ascent to billionaire status.

Utilizing the proceeds, Sumargi acquired substantial properties in New Baneshwar and the Shantinagar area.

Although Sumargi and Singh have recently disassociated from Ncell, Satishlal has emerged as the sole proprietor with a 100% share.

Since its inception, Ncell has faced accusations of influencing political figures and evading taxes, with ongoing legal disputes related to tax evasion.

Furthermore, irregularities in share transactions, including communication authorization lapses, have drawn objections from the Telecommunication Authority, prompting government scrutiny.

Renewing Smart’s license would necessitate a state payment of approximately 27 billion, but if the auction process is pursued after cancellation, the cost is estimated at around 6 billion.

Seven years ago, Axiata purchased 80 percent of Ncell’s shares, now owned by Satishlal Acharya, from Telesonera for 1.43 billion rupees (1.335 million US dollars at the time).

In a surprising turn, seven years later, Axiata sold the shares to Acharya for 50 million US dollars, claiming a loss, despite Ncell’s earnings exceeding 39.51 billion in the last financial year alone.

Acharya, responding to media inquiries, suggested potential earnings of up to 450 million dollars after settling bank loans.

As Ncell’s license faces its final renewal in 2024, speculation arises about a possible maneuver to shift ownership from government hands to private individuals.

Axiata cited an unfavorable investment environment and consistent losses as reasons for withdrawing their investment.

According to regulations, post-August 16, 2029, if Nepali citizens’ shareholding surpasses 50 percent, Ncell need not be nationalized, allowing it to remain in private ownership.

Moreover, Axiata previously attempted to acquire the license of Smart Telecom, recently canceled, to extend the license period.

However, legal complications hindered the completion of this endeavor.

If successful in the Smart auction, Ncell’s license period could be extended for another 10 years.

Smart Telecom, currently undergoing license sales proceedings, faces plans to auction its license, potentially resulting in a 10-year extension for Ncell.

Ongoing efforts to amend laws and regulations aim to facilitate this strategic move.

There are indications that the establishment of Smart Telecom was orchestrated for the benefit of Ncell.

Notably, investors in Smart and Square Network are affiliated with Ncell. Bhawana, who holds Singapore PR, is a key figure owning both Square and Sunivera Capital.

Following concerns over a single individual holding licenses for two communication entities, ownership of the company has been transferred to Bhawana’s relatives.

Since last December, the Telecommunications Authority has assumed ownership of Smart’s license due to non-payment of a 27-billion obligation.

This default has resulted in significant tax losses for the state, prompting the ongoing license sale.

Smart carries a bank loan of 1.5 billion, with additional liabilities for employees and other expenses totaling around 5 billion.

Ncell asserts that, from its establishment to the financial year 078/079, it has contributed over 2.083 trillion in revenue, inclusive of taxes and other charges.

Renewing Smart’s license would necessitate a state payment of approximately 27 billion, but if the auction process is pursued after cancellation, the cost is estimated at around 6 billion.

An amendment to Article 35 of the Regulation has paved the way for this strategic shift.

Tax mess

Ncell was established under the BOOT model, wherein investors construct and operate it for 25 years before transferring ownership to the government.

Six years ago, Axiata acquired 80 percent of Ncell’s shares for 1.043 trillion from the Swedish company Teliasonera.

A dispute arose over whether the buyer or seller should pay the capital gains tax, leading to a current Supreme Court case involving Ncell facing a revenue-related claim exceeding 58 billion.

Despite contributing a substantial portion to the country’s annual budget, with an estimated turnover of nearly 1.5 billion rupees, the Nepalese government has struggled to secure revenue from Ncell.

Previous opposition in the Parliament focused on Ncell’s alleged tax evasion, prompting the tax office to initiate profit tax collection.

Ncell contested this in the Supreme Court, which ruled in favor of tax payment.

Subsequently, Ncell filed a complaint with the Center for Investment Dispute Attribution against the Government of Nepal.

The tribunal ordered Ncell to pay the government-set tax on June 9, 2023, totaling approximately 62 billion in profit tax and fines.

Currently, Ncell is apprehensive about Section 57 of the Income Tax Act, as potential imposition under this clause could result in an additional 57 billion payment.

Axiata, however, advocates for the closure of the double taxation-related file.

Ncell contends a 33.8 percent business decline in 2023, with a 42.1 percent decrease in income and a 74.6 percent reduction in net profit.

To renew its license for the last time in 2024, Ncell, having invested 62.5 billion in infrastructure, is obligated to pay around 20 billion rupees.

SpectraLite UK has acquired 100% ownership of Reynolds Holding Limited, based in St. Kitts and Nevis, Asia, which owns 80 percent of Ncell.

According to Ncell’s Chief Executive Officer and Managing Director Jabbor Kayumov, the company plans to unveil enhanced strategies and expand its service offerings in the coming days.

Ncell asserts that, from its establishment to the financial year 078/079, it has contributed over 2.083 trillion in revenue, inclusive of taxes and other charges.

Also Read:

Comment