0%

First, there was the coronavirus impact on the world economy. It shrunk the economy by 20 percent. Even in Nepal, the private sector defaulted by almost 20 percent.

Their working capital decreased by 20 percent. When the vaccinations started, the economy tried to overcome the adverse impact. The government and Nepal Rastra Bank acted well on it. Even now, many areas are still in the process of recuperation.

Then again there came the global chain impact of the Russia-Ukraine war of 2020. It affected Nepal as well. The price of petroleum products increased. Food prices increased a lot. There was a global energy crisis. Due to the increasing cost, the environment could not be conducive to investment.

Due to the higher price of petroleum products, the logistics cost has become very high. It greatly affected our cost of doing business in both India and China.

This resulted in the devaluation of the Nepalese currency.

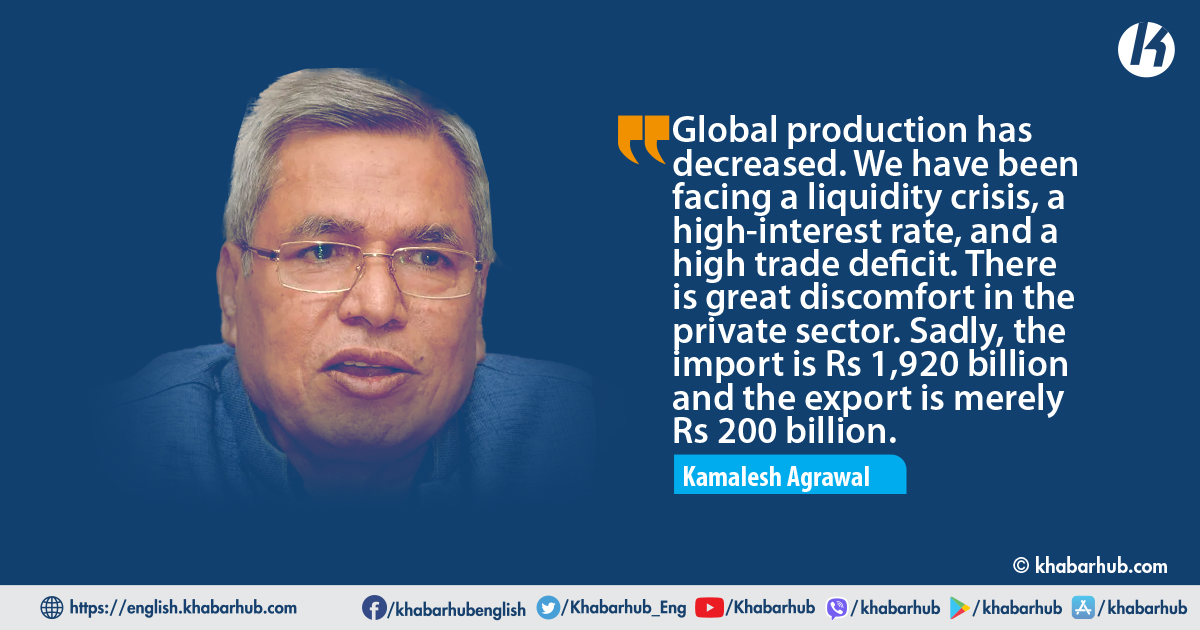

Global production decreased. We have a lack of liquidity, a high-interest rate, and a high trade deficit. There is great discomfort in the private sector. Like, import is 1920 billion and export is merely 200 billion.

The money invested in our industrial sector is not returned. It lasts for a long time. For example, the government changed its policy in the wire industries. The industries were closed. Therefore, this policy should be changed.

Even in the export of 200 billion, almost 70 percent of the products are the ones having no value addition here.

Therefore, the export of our country is very insignificant. Because of this, the private sector is in a very uncomfortable situation.

As we entrepreneurs have to deal with commercial profit and loss, we are ready to bear the global chain impact. We are not offended by that.

But the third impact on us was the contradictory policy introduced by the Central Bank in the private sector, this turned discouraging to the private sector.

For example, it made the provisions like a 100 percent margin or 50 percent margin for import control. It urged to open a letter of credit in the bank for 3 to 4 months, to keep a 100 percent margin, and not to claim interest, etc., we have not been able to understand this.

The banks give interest in 25 hours but we have to keep money in the bank for 4 months without interest. NRB tells us that we are not allowed to claim back interest.

Chain capital is extremely strict as entrepreneurs take it from banks. The morale of the private sector has been greatly depressed due to the lack of loans, there is no money in the market, and we have gone to investigate. Where has the country’s money gone?

So far, the limit given by the banking sector is false because there is three million cement consumption here these days.

It does not have a license. If we look at the steel industry, it is more than the requirement, it is a non-productive sector.

Banks and big houses have asked for a limit, they think they can invest if their money is secure; the small industries do not get any money.

This year’s new budget came with the claim to have GDP growth of 8 percent and an inflation rate of 7 percent.

The three main agencies that influence the economy are the National Planning Commission (NPC), the Ministry of Finance, and Nepal Rastra Bank. There is no correlation between these three bodies. The economy is in shambles.

On the one hand, for a GDP growth of 8 percent, 700 billion in capital needs to be injected in the past. Then only 8 percent GDP growth can be envisaged.

Here, NRB reduced the ‘19 percent loan target’. Money circulation has been reduced from 18 to 12 percent. The statutory liquidity ratio was increased by 2 percent every year from this August.

Before the beginning of this year, the NRB’s interest rate was increased from 5 to 7 at once. And the current monetary policy increased by 1.5 percent.

Looking at the World Bank records, Nepal became the 5th in terms of the bank rate, it increased so much. Due to this, the cost of doing business has increased. Now there are no goods in the market and there is no sale, there is no increase, and everyone is suffering from the interest.

The impacts of each policy have to be considered well before introducing the policy itself. We are blessed with natural resources.

Many traders start to migrate. In this situation, 72 percent of Nepal’s total investment is private sector investment, which should be encouraged. The traders do not have money; it has to be investigated who has it now.

The money invested in our industrial sector is not returned. It lasts for a long time. For example, the government changed its policy in the wire industries. The industries were closed. Therefore, this policy should be changed.

Today, the government gives dollars for whatever commercial purpose. 40 percent customs VAT has been raised on it. It has been emptied on all expenses, so how can we expect the development of the country’s infrastructure if it is emptied on current expenses?

Import control is not something to be done instantly. The government has to make a plan. So that the money spent on imports goes to domestic production.

Nepal is a landlocked country. To make the high-cost business competitive by nearly 20 percent, we need to distribute energy, reduce taxes, and optimize infrastructure.

The government has to pay attention to how to correlate fiscal policy and monetary policy. The government should take responsibility for protecting private sector investment. Many people have been saddened by the fall in the stock market.

The impacts of each policy have to be considered well before introducing the policy itself. We are blessed with natural resources.

But we could not make use of it. But if foreign aid is taken to develop infrastructure, it will not be successful. Such policy leads us to the bitter experience of Sri Lanka.

The currency situation of our country is not good. If the inflow of our currency does not increase, foreigners will not invest.