KATHMANDU: During the week spanning from July 14th to July 18th, 2024, Nepal’s NEPSE index exhibited notable volatility and ended with a significant weekly gain of 2.4%.

Starting the week at 2257.59, the index experienced fluctuations driven by various economic signals and investor sentiments.

The week began with a strong uptick on Sunday, where the index surged by 52.97 points to 2310.59, marking a 3.13% increase.

This initial momentum was tempered by a slight decline of 17.18 points (-0.76%) on Monday, closing at 2240.41, possibly due to profit-taking activities.

However, Tuesday saw a sharp reversal as the index climbed to 2364.63, up by 54.04 points (2.33%), buoyed by renewed confidence and positive market outlook.

The bullish trend continued through Wednesday and Thursday, with gains of 2.33% and 2.52% respectively, culminating in a closing figure of 2424.32 by the end of the week.

This performance underscores a dynamic market environment influenced by both internal economic factors and external market dynamics, highlighting investor responsiveness to earnings reports and broader economic indicators.

NEPSE index gains momentum, surging 2.4% weekly

In the week of July 14th to July 18th, 2024, Nepal’s stock market, represented by the NEPSE index, showed notable fluctuations amidst varied economic indicators.

Starting the week at 2257.59, the index saw a significant absolute increase of 52.97 points and a percentage rise of 2.4% on Sunday, indicating robust initial market sentiment.

However, this optimism waned on Monday as the index dropped by 17.18 points (-0.76%), closing at 2240.41, possibly influenced by profit-taking and cautious trading.

The trend reversed sharply on Tuesday, with the NEPSE index surging to 2310.59, marking a substantial gain of 70.18 points (3.13%), buoyed by renewed investor confidence and positive market outlook.

Wednesday continued the bullish trend with the index reaching 2364.63, up by 54.04 points (2.33%), reflecting sustained buying interest and potential sectoral optimism.

Thursday maintained the upward trajectory, closing the week at 2424.32, up by 59.68 points (2.52%), amid continued positive market sentiment and increased trading volumes. This week’s performance suggests a dynamic market influenced by both internal economic factors and external market dynamics.

Investors appeared responsive to positive earnings reports, economic data releases, and external market trends, driving the index higher throughout the week.

Govt issues 73-point directive to enhance budget discipline

The government has released a comprehensive 73-point directive aimed at enforcing budget discipline across ministries, provinces, and local governments. The circular, made public by the Finance Ministry, focuses on promoting frugality in budget expenditures and enhancing efficiency.

Key areas covered by the guidelines include authority over budget spending, project approval and allocation, project handover and implementation, budget transfers, amendments, and reporting procedures.

Additionally, the guidelines emphasize fiscal transparency, accountability measures, and robust monitoring mechanisms to ensure effective implementation of budgetary measures.

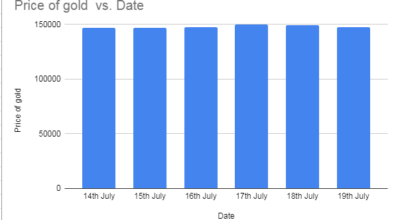

Gold prices in Nepal experience volatile week

During the week of 14 July 2024 to 19 July 2024, gold prices in Nepal exhibited significant volatility, reflecting both local market dynamics and global economic factors.

Starting at Rs 146700 on Sunday, prices saw a gradual increase to Rs 147800 by Tuesday, driven possibly by escalating global economic uncertainties or speculative trading.

Wednesday marked a peak at Rs 149800, signaling heightened investor interest in safe-haven assets amid geopolitical tensions. However, prices retraced slightly to Rs 147500 by Friday, possibly due to profit-taking or reassessment of market conditions.

These fluctuations underscore gold’s role as a hedge against economic instability and currency fluctuations, influencing both investment strategies and consumer sentiment in Nepal.

Moving forward, stakeholders should monitor global economic indicators and geopolitical developments closely as they continue to shape gold price trends in the region, impacting broader economic activities and market sentiment.

Nepal prepares for cross-border electricity trade boost with Bangladesh and India

Nepal anticipates significant advancements in its energy sector, as officials from Bangladesh and India are scheduled to visit on July 28 to finalize an electricity trade agreement.

This agreement, building upon an initial agreement between Nepal and Bangladesh, aims to enable Bangladesh to import electricity from Nepal via Indian transmission lines.

According to the terms, Nepal plans to export 40 megawatts of electricity annually to Bangladesh during the monsoon season, with implementation expected this year pending final approval at the upcoming ministerial meeting.

Kulman Ghising, Executive Director of the Nepal Electricity Authority (NEA), has confirmed that all necessary procedures are in place for initiating electricity exports, projecting earnings of 6.40 cents per unit exported.

This development underscores Nepal’s role in regional energy trade initiatives and signifies a potential boost to the country’s economic landscape.

Nepal’s public debt surges to Rs 2.433 trillion

During the fiscal year 2079–80, Nepal’s public debt stood at Rs 2.299 trillion, increasing to Rs 2.433 trillion by the end of 2080–81, marking a rise of Rs 134.6841 billion over the year.

The Public Debt Management Office reported an increase of Rs 32.8958 billion in debt from the previous month of Jestha alone.

Between Shrawan and Ashad of the preceding fiscal year, an additional Rs 134 billion was accumulated, bringing the total debt to Rs 2.433 trillion.

Currently, Nepal’s debt-to-GDP ratio stands at 42.65%, equivalent to Rs 5.7 trillion. While government officials argue that debt levels up to 43% of GDP are manageable, economists caution that surpassing the 40% threshold signals potential economic risks for Nepal.

(Prepared by Srija Khanal)

Comment