Ships may be the new battleground for the European Union’s (EU) willingness to loosen its antitrust rules.

Cruise ship builders Fincantieri in Italy and Chantiers de l’Atlantique in France attempt to create an industrial heavyweight to counter China’s rise as a cruise ship builder.

These companies argue that if European shipbuilders continue to be constrained by rules protecting competition in Europe, Chinese companies with significant financial resources and with technological capacity comparable to that of Europe will take hold of the European shipbuilding market and outcompete European companies.

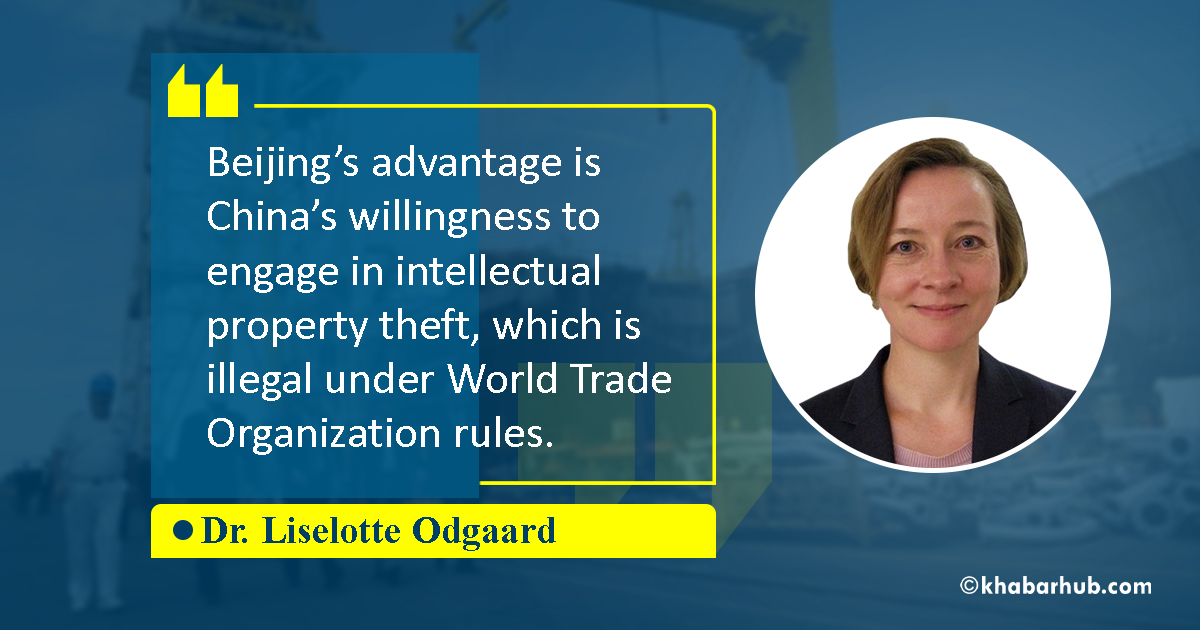

However, the battle for European shipbuilding is already almost lost. Beijing’s advantage is China’s willingness to engage in intellectual property theft, which is illegal under World Trade Organization rules.

Europe’s maritime industry has a strong supply chain in northern Europe, which China has accessed, either through design collaboration agreements or through acquisitions.

Through intangible technology transfers by means of direct investments, mergers and acquisitions, research cooperation, and the transfer of data in nonphysical form, China has made major inroads into the European shipbuilding industry.

In many cases, China has already taken over companies or redirected companies’ production to areas that have not yet been hit by competition from China. In other words, the European maritime industry is very close to losing the ongoing battle with China for shipbuilding. Here is how it happened.

Europe’s maritime industry has a strong supply chain in northern Europe, which China has accessed, either through design collaboration agreements or through acquisitions.

China copies advanced innovative ship designs, often resulting in domestic copies of these designs within as little as a year.

Provided the copy is successful, China starts developing a domestic supply chain and acquires companies that have key technologies in the supply chain, such as engine producers.

The final step is to establish economies of scale by consolidating the Chinese design competencies in one large company, such as China State Shipbuilding Corporation (CSSC).

European and US competitiveness is threatened across a wide range of maritime productions related to the building of ships such as cruise ships, cargo ships, and frigates.

This state-owned enterprise is the world’s biggest shipbuilding corporation and has enormous financial backing from the Chinese state.

In 2019, the Chinese government merged the country’s top two shipbuilders, CSSC and China Shipbuilding Industry Corporation (CSIC), which has a global market share of 20 percent.

The new super-conglomerate is expected to greatly boost China’s shipbuilding industry and facilitate the building of a strong navy.

Through illegitimate market economic practices, China is positioning itself as an industrial civilian and naval shipbuilding giant capable of significantly reducing the market share of Western companies.

In 2019, the European Commission blocked a merger of the largest regional suppliers in the European rail market, Alstom in France and Siemens in Germany, despite prior French and German governmental approval, because the Commission believed that the merger would harm competitiveness.

The risk is high that the newly appointed Commission will repeat the mistake regarding Europe’s maritime industry with reference to their understanding that China is not yet competitive in the market for cruise liners.

China is producing naval platforms at the same production sites as its commercial fleet, again aiming at economies of scale to make China a major independent arms manufacturer.

The Commission’s lack of forward thinking on China’s industrial policies and the consequences for European shipbuilding has received almost no attention in Western debates despite the serious economic and security challenges posed by China’s emergence as a major force in the shipbuilding industry.

European and US competitiveness is threatened across a wide range of maritime productions related to the building of ships such as cruise ships, cargo ships, and frigates.

This could lead to a loss of jobs and profit. In the long term, it could also lead to a loss of standard setting influence, a development that is already starting to emerge in some high-tech sectors where China has taken the lead.

At the moment, China is experimenting with the establishment of a standardization organization that would be available to partners of the Belt and Road Initiative (BRI), China’s program for global economic development.

Standard setting can be used by China as a barrier for companies from non-BRI countries to enter markets, because such countries do not have access to the key technologies and designs required to meet the standards.

The security challenges arising from Chinese shipbuilding are equally worrying. China is on the threshold of establishing economies of scale in shipbuilding, producing commercial and military vessels in large quantities.

China has already quickly expanded its naval forces and continues to develop the People’s Liberation Army Navy (PLAN) into a global force to protect China’s global economic and security interests.

The PLAN’s latest Chinese-produced surface and subsurface platforms such as missile-guided destroyers, high-capability intelligence collection ships, and autonomous underwater vehicles are key to future naval warfare.

China is producing naval platforms at the same production sites as its commercial fleet, again aiming at economies of scale to make China a major independent arms manufacturer.

This development enables China to carry out naval operations beyond China’s immediate neighborhood and poses a threat in regions such as the Americas and the Arctic—far from China’s shores.

Instead of protecting internal European competitiveness, the European Commission needs to focus on saving European industries from state-supported Chinese competition across a wide range of industries.

This can only be done by allowing Europe to build companies sufficiently large to compete globally. The threat to Europe’s economic health does not come from within. It comes from China’s global competition.

(The writer is a Senior Fellow at Hudson Institute, US)

Comment