KATHMANDU: Last week, the Nepal Rastra Bank (NRB) unveiled major monetary policy reforms for the fiscal year 2081/82 (2024/25) to invigorate economic activity and bolster financial stability.

The reforms include removing the cap on share collateral loans for institutional investors to enhance margin trading, lowering provisioning requirements for performing loans to boost bank profitability, and reducing policy rates to stimulate borrowing and investment.

The policy also focuses on consolidating the microfinance sector, simplifying loan restructuring, and managing risks in real estate and high-value vehicle loans.

Additionally, NRB has introduced a refund mechanism for depositors using cooperative assets as collateral and expanded securities brokerage participation to lessen direct bank investments in the securities market.

NRB’s monetary policy: Reforms to stimulate economy and strengthen financial stability

The Nepal Rastra Bank (NRB) unveiled its monetary policy for the fiscal year 2081/82 (2024/25), featuring several key changes to boost economic activity, stabilize finances, and address sector-specific issues last week.

The policy has removed the cap on share collateral loans for institutional investors to invigorate margin trading and reduce bank lending in the securities market, while maintaining caps for individual investors.

It has also reduced the provisioning requirement for performing loans, which is expected to enhance bank profitability.

The policy has emphasized microfinance sector consolidation and customer protection, introduced easier loan restructuring options, and cut policy rates to stimulate borrowing and investment.

Additionally, it has addressed risks in real estate and high-value vehicle loans, and ensures the return of up to Rs 500,000 for depositors using cooperative assets as collateral.

By adjusting the interest rate corridor and maintaining liquidity ratios, NRB aims to balance growth with stability, fostering a dynamic economic environment while managing monetary conditions effectively.

Refund measure for depositors, removes cap on share mortgage loans

Nepal Rastra Bank (NRB), in its monetary policy, has introduced a new initiative to refund depositors up to Rs 500,000 by using the assets of cooperative operators and their families as collateral, as part of the fiscal year 2081/82 monetary policy.

This measure, announced by Governor Maha Prasad Adhikari, aims to address issues within the cooperative sector and follows a prior promise by former Finance Minister Barsaman Pun to return similar deposit amounts.

Additionally, NRB has lifted the Rs 200 million cap on share mortgage loans in the new policy, which also authorizes 34 securities brokerage firms to facilitate margin trading, intending to reduce direct bank investments in the securities market and support institutional investors.

The policy further includes reductions in the policy and bank rates, with the policy rate dropping from 5.5% to 5% and the bank rate from 7% to 6.5%, measures designed to stimulate activity in the sluggish construction sector.

The policy introduces collateral-free loans for individuals with foreign work permits, provided their remittances are deposited into bank accounts.

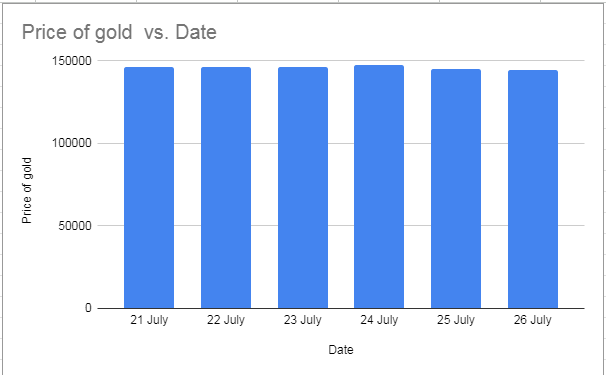

Gold prices exhibit volatility with mid-week spike and subsequent decline

In the week starting from July 21st, 2024, gold prices in Nepal exhibited notable fluctuations, reflecting a dynamic market. The week began with gold priced at Rs 146,500, but prices saw a slight decline to Rs 146,300 on both July 22nd and 23rd.

This initial drop could suggest a period of stable demand or minor market adjustments.

However, on July 24th, prices surged to Rs 147,400, potentially indicating a temporary spike in demand or market uncertainty that drove up prices.

This increase was short-lived, as gold prices fell back to Rs 145,000 on July 25th, and further declined to Rs 144,700 by July 26th.

The downward trend towards the end of the week may reflect a return to market equilibrium or reduced investor enthusiasm.

Overall, the week’s gold price movements highlight a volatile market with fluctuating demand and potential external influences impacting prices.

NEPSE experiences mixed week with sharp gains and corrections

During the week of July 21st to July 25th, 2024, the Nepal Stock Exchange (NEPSE) displayed significant volatility.

The week commenced with a robust increase on July 21st, as the index rose by 2.54% to close at 2,485.94, reflecting a strong upward momentum.

This positive trend continued into July 22nd with a marginal increase of 0.08%, bringing the index to 2,488.09.

However, July 23rd saw a notable surge of 3.02%, with the index climbing to 2,563.43, potentially driven by heightened investor optimism or favorable market conditions.

The momentum faltered on July 24th, as the index dropped by 1.06% to 2,536.11, possibly due to profit-taking or market corrections.

On July 25th, the index rebounded with a gain of 1.26%, ending the day at 2,568.13, suggesting renewed confidence or positive developments in the market.

Overall, the NEPSE’s weekly performance highlights a period of market fluctuation with significant swings, reflecting underlying uncertainties and investor sentiment shifts.

Nepal exports electricity worth nearly Rs 17 billion to India

In the last fiscal year, Nepal’s electricity trade with India revealed a notable balance, with exports valued at Rs 16.93 billion, primarily during the monsoon season when hydropower generation was high and sold at Rs 8.72 per unit.

In contrast, Nepal imported electricity worth Rs 16.81 billion from India to address shortfalls during the dry season, with the cost averaging Rs 9.17 per unit.

This exchange underscores Nepal’s reliance on cross-border electricity trade to manage seasonal fluctuations in production and demand, highlighting the economic interplay between surplus production and necessary imports to stabilize the national grid.

India increases grant to Nepal to INR 7 billion for FY 2024/25

India has unveiled a grant of INR 7 billion for Nepal in its current fiscal year, marking an increase of over INR 500 million from the previous year.

This announcement was made during the FY 2024/25 budget presentation by Finance Minister Nirmala Sitharaman, following the establishment of a new coalition government under Prime Minister Narendra Modi.

Last fiscal year, India initially pledged INR 5.50 billion (Rs 8.80 billion) to Nepal, a figure that was subsequently revised upward to INR 6.50 billion (Rs 10.40 billion).

(Prepared by Srija Khanal)

Comment