KATHMANDU: Last week in Nepal witnessed a dynamic economic landscape: investors advocated for a reduction in capital gains tax to stimulate market activity, while the Nepal Stock Exchange (NEPSE) displayed bullish momentum, signaling strong investor confidence.

Conversely, gold prices experienced volatility, reflecting market uncertainty. Commercial banks responded to sluggish loan demand by lowering base interest rates to seven percent, aiming to spur borrowing and economic growth.

However, Nepal’s public debt hit a record high of nearly Rs 2.4 trillion, underscoring significant fiscal challenges, and provincial GDP trends highlighted economic disparities, with Bagmati Province leading and Karnali Province lagging behind.

These developments underscore the need for strategic fiscal policies to navigate challenges and promote balanced economic growth across regions.

Govt arrears surge to over Rs 1.18 trillion: OAG Report

The Office of the Auditor General (OAG) reported that government arrears have soared to over Rs 1.18 trillion. This total includes debts owed by federal, provincial, and local government offices, as well as institutional corporations.

This surge underscores the need for improved financial management and accountability across all levels of government.

The OAG’s 61st annual report revealed that the last fiscal year, 2079/80, alone saw arrears amounting to Rs 236 billion. Specifically, federal, provincial, and local government offices, along with corporations, owed Rs 669 billion. Additional liabilities from auditing, revenue dues, and amounts to be reimbursed after settling foreign grants and loans totaled Rs 513 billion.

The cumulative arrears and dues to be collected amount to Rs 1.183 trillion. Federal government offices are responsible for Rs 342 billion, provincial government offices owe Rs 28.46 billion, and local government offices account for Rs 193 billion.

Govt projects 3.9 percent economic growth

The government has forecasted a 3.9% economic growth for the current fiscal year amidst political opposition. Finance Minister Barsaman Pun presented the Economic Survey and Annual Review of Public Institutions in parliament.

Key projections include a 3.8% increase in total investment, with Per Capita Income expected to reach $1,456. Inflation is at 6.08%, while revenue collection rose by 6.9%. This projection provides an indication of the expected expansion of the country’s economic output over the specified period.

Minister Pun’s projection suggests a formal review and analysis of the nation’s economic performance and public institutions, providing insights into various aspects of governance and economic management.

Investors request capital gains tax reduction in FY budget

Investors in Nepal engaged with the government, expressing their desires for changes in tax policy. This suggests a proactive and engaged investment community that is closely monitoring fiscal policies and advocating for reforms that could potentially benefit them.

The request for a reduction in capital gains tax signals the importance of tax policy in shaping investment decisions. Lowering the tax burden on capital gains could incentivize more individuals to invest in the stock market, potentially leading to increased liquidity and activity in the market.

They also highlighted details on the current tax structure, highlighting the distinction between short-term and long-term capital gains taxes, which they have argued was essential for understanding the specific changes being proposed by investors and the potential impact of these changes on different types of investors and investment horizons.

The proposed amendments aim to achieve multiple objectives, including encouraging individual participation in share trading, simplifying tax collection processes, and ultimately boosting government revenue. By reducing tax rates on capital gains, investors hope to stimulate investor confidence and trading activity, which could have positive spillover effects on the overall economy.

If implemented, the proposed tax reductions could have significant implications for Nepal’s capital market and broader economy.

Nepal Stock Exchange (NEPSE) Performance

Throughout the week of May 19th to May 22nd, the Nepal Stock Exchange (NEPSE) showcased remarkable bullish momentum, witnessing consecutive gains in its index.

NEPSE surged by 45.69 points on Sunday, followed by increases of 27.54 points on Monday, 23.94 points on Tuesday, and 15.54 points on Wednesday. The cumulative capital gain for the week amounted to an impressive Rs 178 billion, reflecting robust investor confidence and market optimism.

This surge in NEPSE index underscores positive market sentiment and strong investor participation, positioning Nepal’s stock market as an attractive investment destination.

Overall, the bullish momentum observed in NEPSE during this period underscores the positive outlook for Nepal’s stock market, driven by factors such as investor confidence, market optimism, and strong participation. However, it’s essential to monitor future market movements to assess the sustainability of this trend and its underlying drivers.

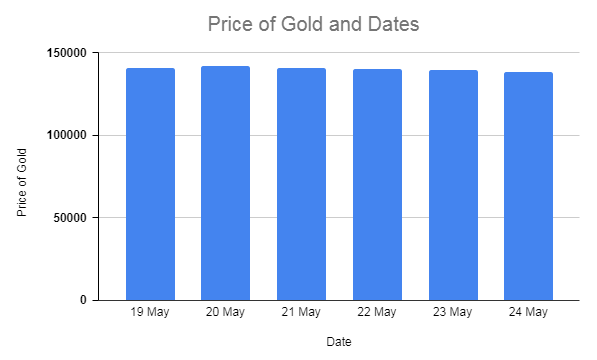

Gold prices experience volatile week, reflect market uncertainty

Throughout the week, gold prices in the market showed considerable volatility. Starting strong on Sunday with a notable increase of Rs 1600, reaching Rs 140900, the prices remained stable on Monday at Rs 141800. However, by Tuesday, there was a slight decline of Rs 1200, settling at Rs 140600.

This trend continued with minimal changes on Wednesday at Rs 140500. Yet, Thursday and Friday witnessed significant decreases, with gold prices dropping by Rs 1800 each day, closing the week at Rs 139800 and Rs 138500, respectively. The overall trajectory indicates a mixed week for gold, showcasing both gains and losses, reflecting the uncertainty and fluctuations in the market.

Banks lower base interest rate to 7 percent

Nepal’s commercial banks have slashed their base interest rates to as low as seven percent, responding to sluggish loan demand and surplus liquidity. This strategic maneuver aims to utilize excess funds and reinvigorate borrowing activity.

The success of this strategy hinges on its ability to stimulate lending and foster economic expansion. Over the past months, banks have consistently lowered their interest rates, with base rates dropping by 22 percentage points between mid-May and mid-June.

Recent data from 20 commercial banks indicates an average base rate of 8.53 percent, down from 9.69 percent in January. Nepal Rastra Bank data highlights a deposit surplus of Rs 955 billion compared to loans, with deposits totaling Rs 5.477 trillion and loans at Rs 4.522 trillion as of May 20.

Furthermore, lending rates, inclusive of base rates, have also decreased, with Standard Chartered Bank Nepal offering the lowest at 7.01 percent and Kumari Bank the highest at 9.63 percent.

Nepal’s Public Debt Hits Rs 2.4 Trillion, Signaling Fiscal Challenges

Nepal’s public debt has soared to nearly Rs 2.4 trillion, marking a Rs 98 billion increase over the last 10 months of the current fiscal year, according to the Public Debt Management Office (PDMO).

This surge, fueled by both domestic and international borrowing, underscores significant fiscal hurdles. Tackling these challenges through strategic debt management, fiscal reforms, and initiatives for economic growth is crucial for ensuring long-term fiscal stability.

At the fiscal year’s onset, public debt stood at Rs 2.299 trillion, now constituting 42.02 percent of the GDP, with a recent monthly increase of Rs 11.64 billion. Internal debt represents 20.76 percent of GDP, while foreign debt accounts for 21.26 percent.

Up to the end of Baisakh, the government borrowed Rs 264.63 billion and repaid Rs 166.55 billion in principal, with Rs 191 billion from internal loans and Rs 73.63 billion from foreign loans.

Bagmati leads, Karnali lags: Provincial GDP trends highlight economic disparities

Bagmati Province is poised to lead the nation’s GDP contribution, while Karnali Province is expected to have the smallest share, according to the National Statistics Office’s Provincial GDP estimates for 2080/81 BS.

Bagmati is projected to contribute 36.4% to the GDP, followed by Koshi at 15.8%, Lumbini at 14.3%, Madhesh at 13.1%, Gandaki at 9.1%, and Sudurpaschim at 7.1%. Karnali Province is anticipated to have the smallest share at 4.3%. Minor fluctuations in GDP contribution have been observed compared to the previous fiscal year, with some provinces experiencing slight declines while others see modest increases.

The estimated GDP at consumer price for the current fiscal year is Rs 575 billion. The National Statistics Office’s active monitoring of economic activities since the adoption of federalism aims to support evidence-based policy decisions and mitigate socioeconomic disparities.

(Prepared by Srija Khanal)

Comment