KATHMANDU: The private telecommunications company Ncell has long been mired in controversy, primarily due to issues surrounding capital gains tax on share transactions and the influential figures involved.

The buying and selling of Ncell shares have often caused a stir.

The latest controversy erupted after Malaysian company Axiata Group issued a press release on December 1, 2023.

Satishlal Acharya’s offshore company, SpectraLite UK Limited, announced the sale of its 100 percent ownership in Axiata UK Limited to Reynolds Holdings.

Reynolds Holdings is a company registered in St. Kitts and Nevis, a tax haven.

Reynolds Holdings owned 80 percent of Ncell, while the remaining 20 percent was held by Bhawana Singh Shrestha, Satishlal Acharya’s wife.

Previously, shares purchased from the Swedish company TeliaSonera for NPR 104.4 billion were sold at a significantly lower price of USD 50 million (approximately NPR 6.5 billion) seven years later, sparking outrage among Nepal’s regulatory bodies, Parliament, media, and political parties.

The government faced mounting pressure as the Public Accounts Committee, Finance Committee, and State Affairs Committee of Parliament initiated inquiries into the unusual pricing of Ncell shares.

Calls for a thorough investigation into the Ncell share transactions grew louder.

In response, the government formed a five-member investigation committee, led by former Auditor General Tankamani Sharma Dangal, on December 7, 2023.

The Dangal-led committee submitted its report on January 29, 2024, following an extensive study.

Despite the report’s completion, the government has kept its findings confidential.

However, Khabarhub has obtained the report from a high-level government source.

According to the report, Dr. Upendra Mahato, the founding president of the Non-Resident Nepali Association (NRNA) and a prominent businessman, is accused of engaging in serial tax evasion and other financial misconduct related to Ncell.

The report recommends that he be investigated and that appropriate action be taken against him.

The high-level study and investigation committee, led by Tankamani Sharma, highlighted the onset of irregularities at Ncell, tracing them back to Dr. Upendra Mahato.

The report indicates that Mahato’s company engaged in Ncell transactions outside Nepal and failed to pay taxes on the profits earned in Nepal.

The government’s investigation into Ncell raised serious concerns regarding the sale of shares.

It was discovered that Dr. Mahato evaded taxes, utilized an offshore company for business dealings in Nepal, and conducted transactions involving local shares despite being a non-resident Nepali, thus engaging in illegal offshore activities.

Details of Mahato’s share transactions

Pages 30, 31, and 32 of the government investigation report provide a comprehensive table detailing Ncell’s share transactions from its inception.

According to the report: Spice Nepal Pvt Ltd was established on June 21, 2001, to provide mobile services in Nepal with an initial capital of Rs. 10 million.

On November 18, 2004, Raj Group Nepal, owned by Raj Bahadur Singh, son-in-law of former King Gyanendra Shah, acquired shares from Modi Corp and Khaitan Group. Subsequently, Spice Nepal’s share capital was increased to Rs. 10 million.

Following this, Raj Group’s 95 percent stake in Spice Nepal was acquired by Dalto Trade Cyprus, which purchased 57 percent of the shares from Raj Group.

The Center for Investigative Journalism also noted that during the sale of other shares from the same company in 2008, transactions amounting to Rs. 13.79 billion (approximately USD 203 million) appeared to have been conducted outside Nepal.

Meanwhile, the Center for Investigative Journalism’s research revealed that Dalto Trade Cyprus, with a Cypriot address, is affiliated with Dr. Upendra Mahato, the founding president of the Non-Resident Nepali Association and a prominent businessman.

According to the report, Dr. Mahato’s Reinhold Holding, registered in the tax haven of St. Kitts and Nevis, acquired 40 percent of Dalto Trade’s shares on March 30, 2005 — four months after Dalto entered Nepal in December 2004.

Investigations have revealed that Mahato utilized companies from Nepal, India, Cyprus, and St. Kitts and Nevis, such as Dalto Trade and Reinhold Holding, to evade taxes.

This confirms that Dr. Mahato and his affiliated companies have been engaged in share transactions involving Ncell.

In a petition filed with the Supreme Court in 2015, it was noted that Reinhold Holding was established specifically to target Ncell, with its business solely focused on Ncell at that time.

Reinhold Holding’s exclusive focus on Ncell is further evidenced by its writ petition (074-W-0377) to the Supreme Court, along with related documents.

The petition includes a statement from Axiata dated April 12, 2016, and a press release from TeliaSonera dated April 11, 2017.

Following the entry of Mahato’s affiliates, Dalto Trade from Cyprus and Reinhold Holding from St. Kitts and Nevis, into Nepal, Raj Group Nepal’s share in Spice Nepal Ltd. was reduced to 38 percent, while Spice Nepal’s own share was reduced to 5 percent.

According to the government report, on March 6, 2006, Reinhold Holding increased its stake to 58.6 percent by purchasing an additional 18.6 percent of Raj Group’s shares.

On June 6, 2006, Synergy Nepal Pvt Ltd, also headed by Mahato, acquired 8 percent of Raj Group’s shares in Ncell.

By October of the same year, Synergy Nepal Pvt Ltd. had been incorporated, further consolidating Mahato’s control.

The report reveals that, after acquiring 5 percent of Spice Nepal’s shares from India on Deember 13, 2007, Spice Nepal held 60 percent of Reinhold Holding, 20 percent of Dalto, and 20 percent of Synergy.

Mahato then sold all of Dalto’s shares to Reinhold Holding and renamed Spice Nepal to Ncell Pvt Ltd.

Subsequently, Dr. Mahato repurchased Synergy Nepal Pvt Ltd.’s shares in his own name on March 29, 2012, and sold them to his business partner Niraj Gobinda Shrestha on April the same year.

According to the Center for Investigative Journalism, Dr. Shrestha received an 18.61 billion rupee loan from a tax haven to purchase 20 percent of Mahato’s shares.

However, in his written response to the Supreme Court in 2018 concerning capital gains tax, Shrestha claimed he acquired the shares for just 25 crore rupees.

Page 105 of the report emphasizes the need to investigate these serious cases of foreign currency embezzlement and capital flight, considering asset laundering and foreign exchange regulations.

The Center for Investigative Journalism also noted that during the sale of other shares from the same company in 2008, transactions amounting to Rs. 13.79 billion (approximately USD 203 million) appeared to have been conducted outside Nepal.

This suggests that capital gains tax may have been evaded through Mahato’s business dealings.

The 73rd report of the General Accountant also touched on these issues.

On March 29, 2012, when Dr. Mahato sold shares to Niraj Gobinda Shrestha, the book value per share was set at NPR 16,821.

The Taxpayer’s Office report indicated that Mahato evaded profit tax amounting to NPR 3,294,487,051 based on this valuation.

Dr. Mahato had declared his tax liability, along with income statements for the fiscal years 2008/09 and 2009/10, amounting to only NPR 44,472,013 as of January 2013.

According to the Taxpayer’s Office, he had already evaded more than NPR 3.25 billion in profit tax.

In a written reply to the Supreme Court, the Taxpayer’s Office reported that Mahato concealed profits of NPR 32 billion from the shares sold.

Dr. Niraj Gobinda Shrestha, who acquired 20 percent of the shares from Mahato, secured a loan from abroad to complete the transaction.

The 73rd report of the Auditor General also touches on this issue, suggesting a connection to Mahato.

The report highlighted that, in the fiscal year 2015/16, a non-resident taxpayer owning 20 percent of the shares attempted to evade tax by taking a loan of NPR 20 billion abroad.

This issue is attributed to Niraj Gobinda Shrestha based on the report prepared under the leadership of Tankamani Sharma Dangal.

When Shrestha purchased the shares from Upendra Mahato, the Audirot General’s report noted that while 80 percent of the shares were valued at NPR 104.478 billion, the 20 percent share was valued at only NPR 11.326 million.

Former Auditor General Sukdev Bhattarai Khatri stated that the 73rd report raised concerns about the 20 percent share transactions.

He later informed Khabarhub that he resigned due to pressure not to include certain issues from the 73rd report.

Khatri remarked, “The 73rd report addressed the 20 percent share transaction in detail. However, subsequent reports appeared to omit this issue. I heard that the file was hidden, and I mentioned this in my resignation statement.”

Conversely, if they were Nepali citizens at the time, their foreign investments and loan transactions would violate the Foreign Exchange (Regulation) Act, 2019, as noted on page 33 of the government report.

Khatri explained that the issue was effectively closed as further General Accountant reports failed to address previous transaction concerns.

The Ncell purchase and sale investigation report also notes that some individuals, under the guise of Nepali nationality, are establishing companies in tax havens to embezzle foreign currency.

Page 105 of the report emphasizes the need to investigate these serious cases of foreign currency embezzlement and capital flight, considering asset laundering and foreign exchange regulations.

The report further identifies countries such as Belize, the Bahamas, the Cayman Islands, Cyprus, the Dominican Republic, Singapore, the British Virgin Islands, and St. Kitts and Nevis as notorious for such transactions, noting that Ncell’s holding company and share trading entities are based in these jurisdictions.

Trading local shares as a foreigner

Dr. Upendra Mahato, who has been implicated in defrauding billions in capital gains tax by trading Ncell shares offshore under various domestic and foreign company names, has also violated the Telecommunication Policy 2060.

The Telecommunication Policy 2060 mandates that at least 20 percent of investment in foreign-invested telecommunications companies must be domestic.

However, Dr. Mahato, who became a non-resident Nepali, is found to have illegally traded Ncell shares on behalf of various companies and even in his own name.

The Non-Resident Nepali Association (NRNA) was established during a conference held in Kathmandu from October 11 to 14, 2003.

Typically, individuals must relinquish their Nepali citizenship to become non-resident Nepalis.

Dr. Mahato was the founding president of the NRNA. Records indicate that he was not a Nepali citizen prior to October 2003.

Despite this, transaction details show he has been involved in trading both foreign and local shares in Ncell.

The government’s research report has highlighted the need to investigate the legal validity of the 20 percent shares purchased by Mahato through Synergy Nepal and the subsequent sale of those shares to Niraj Gobinda Shrestha.

It appears that the parliamentary committees, political leaders, intellectuals, and media, who have been vigilant since the controversy surrounding Ncell’s share transactions emerged, are gradually losing momentum on the issue.

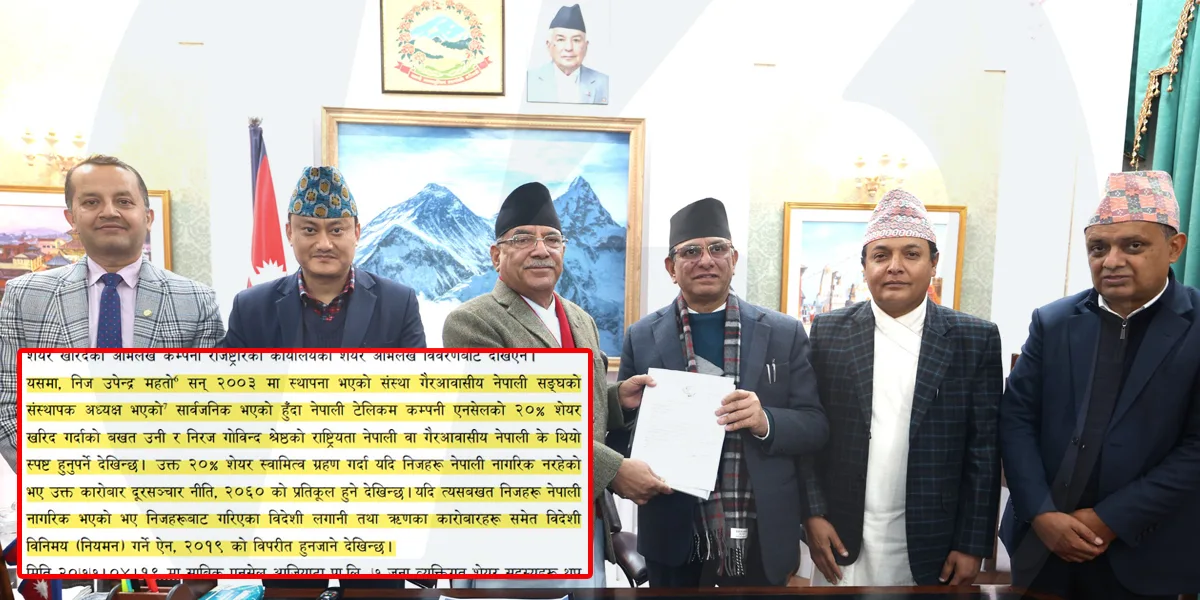

Since it is public knowledge that Upendra Mahato is the founding president of the Non-Resident Nepali Association, an organization established in 2003, questions arise regarding the nationality of Mahato and Niraj Gobinda Shrestha at the time they acquired 20 percent of the shares in the Nepali telecom company Ncell.

If they were not Nepali citizens while holding these shares, such transactions would contravene the Telecommunication Policy 2060.

Conversely, if they were Nepali citizens at the time, their foreign investments and loan transactions would violate the Foreign Exchange (Regulation) Act, 2019, as noted on page 33 of the government report.

The report also emphasizes on page 54 that further investigation is needed into Dr. Mahato’s buying and selling activities related to Ncell.

According to the Telecommunication Policy, 20 percent of investment in foreign telecommunications companies should come from Nepali citizens.

The report indicates that Upendra Mahato acquired shares from Synergy Nepal Pvt Ltd in 2011.

These shares were then sold to Niraj Gobind Shrestha approximately nine days later.

The report queries whether Mahato conducted these transactions as a Nepali citizen or as a non-resident Nepali.

Dr. Mahato’s actions are clearly addressed in the report. If he conducted his business as a foreign investor, it would have been in violation of the Telecommunication Policy 2060.

Conversely, if he operated as a Nepali citizen, he would have breached the Foreign Exchange (Regulation) Act.

The government investigation underscores that Dr. Mahato should be scrutinized for potential illegalities related to the purchase and sale of Ncell shares, regardless of whether he was a Nepali citizen or a foreign national.

According to the Telecommunication Policy 2060, at least 20 percent of the investment in telecommunications service providers must be from Nepali investors.

Given that 80 percent of Ncell’s shares were held by foreigners, there are concerns that even the 20 percent held may have involved non-Nepali citizens at various times.

This situation warrants further investigation by the relevant agencies, as noted on page 111 of the government investigation report.

Additionally, the report specifically calls for an investigation into the purchase and sale of 20 percent of Ncell’s shares.

It highlights concerns such as the concealment of wealth sources, illegal foreign currency trading, and revenue fraud.

Ramhari Khatiwada, Chairman of the State Affairs and Good Governance Committee, informed Khabarhub that they are closely monitoring the implementation of the committee’s instructions given to the government last November and assessing any potential shortcomings.

The report suggests that the Prevention of Asset Laundering Act, the Foreign Exchange Act, and the Revenue Leakage Act, be relevant to these share transactions.

After Ncell was renamed Ncell Aziata Pvt Ltd, Niraj Gobinda Shrestha sold 20 percent of his shares to Sunivera Capital Ventures Pvt Ltd, a company owned by Bhavna Singh Shrestha, wife of Satishlal Acharya, through an offshore transaction.

Since then, 80 percent of the shares have been held by Reinhold Holding and 20 percent by Sunivera, both of which are registered in St. Kitts and Nevis, a known tax haven.

Both companies are directly or indirectly linked to Dr. Mahato.

When Khabarhub attempted to contact Dr. Upendra Mahato for comment on these allegations, he did not answer calls or respond to messages, despite being informed about the serious allegations and inquiries.

It appears that the parliamentary committees, political leaders, intellectuals, and media, who have been vigilant since the controversy surrounding Ncell’s share transactions emerged, are gradually losing momentum on the issue.

Last year, following Aziata Bahard’s announcement of the sale of Ncell, several parliamentary committees—including the Public Accounts Committee, the Finance Committee, the State Affairs and Good Governance Committee, and the Education and Information Communication Committee—held meetings to address the matter.

The Public Accounts Committee, during its meeting, concluded that the sale of Ncell by the Malaysian company Aziata was conducted without informing the regulatory body, the Telecommunication Authority.

The committee deemed the transaction dubious, opaque, and unrealistic.

Similarly, the State Affairs and Good Governance Committee also decided to instruct the Prime Minister’s Office, the Ministry of Finance, and the Ministry of Industry to withhold consent and approval for the share transaction until the investigation committee’s report was received.

Rishikesh Pokhrel, Chairman of the Public Accounts Committee, stated that despite repeated requests, the government has not provided the committee with the report.

He told Khabarhub that the committee had previously written to the Commission for the Investigation of Abuse of Authority (CIAA) to investigate the Ncell share transactions, but further discussion on the matter had ceased.

Despite the committee’s recommendations, the government announced it would implement the report but did not make it public or advance the investigation as suggested.

“Last year, we requested the CIAA to investigate the Ncell purchase and sale, and since then, we have not received any updates,” Pokhrel stated.

“According to the Ncell agreement, the government should assume ownership within a specified period.”

When contacted for a response, CIAA spokesperson Narahari Ghimire stated that he had no information regarding the matter.

Ghimire’s response suggests that the Authority has not taken further action on the investigation.

Ramhari Khatiwada, Chairman of the State Affairs and Good Governance Committee, informed Khabarhub that they are closely monitoring the implementation of the committee’s instructions given to the government last November and assessing any potential shortcomings.

“The Prime Minister’s Office Cabinet Secretariat has indicated that the implementation process is underway,” Khatiwada said.

“We have received correspondence from the Cabinet and the Ministry of Communications requesting that share transactions be halted. We are also aware that the Ministry of Communications is progressing with the process to bring Ncell under the Government of Nepal’s ownership.”

The report also highlights violations of Nepal’s Foreign Investment Policy, 2060, underbilling in recent transactions, and questionable financial practices including tax evasion schemes and unreported “Hundi” (illegal transaction) crypto transactions.

While the Public Accounts Committee and the State Affairs Committee superficially examined the Ncell share transactions, they have failed to thoroughly investigate the role of tax evasion in these dealings from the outset.

During the discussion held by the Public Accounts Committee, there was no mention of the 20 percent local shares involved in the Ncell transactions.

On December 8, 2023, independent parliamentarian (MP) Dr. Amaresh Kumar Singh filed a petition with the Supreme Court seeking to halt the latest Ncell share transactions.

Singh also publicly alleged that even former Prime Minister Pushpa Kamal Dahal ‘Prachanda’s’ family was implicated in the opaque dealings surrounding Ncell.

The Supreme Court issued a show-cause order in response to Singh’s writ, which is still under consideration.

Singh informed Khabarhub that his writ remains under review and that the government has not provided the requested report.

Concerns over government’s role in serious matters

Last year, the government formed a committee led by former Auditor General Tankamani Sharma, along with Secretary Phanindra Gautam, Joint Secretary Ritesh Kumar Shakya from the Ministry of Finance, Joint Secretary Baburam Bhandari from the Ministry of Communication and Information Technology, and ICAN Chairman Sujan Kumar Kafle, to investigate the sale of Ncell shares.

Khabarhub has obtained the report prepared under Tankamani Sharma’s leadership regarding the Ncell transactions. However, the government has kept this report confidential for an extended period.

The committee submitted its report to then-Prime Minister Pushpa Kamal Dahal ‘Prachanda’.

Despite its consistent profitability compared to other foreign companies, Ncell’s offshore business practices and the lack of a favorable investment environment in Nepal have led to criticism for the state’s failure to address these issues effectively.

In presenting the report, Tankamani Sharma noted that since the required documents confirming the technical, financial, and managerial capacity of the buyer had not been submitted, the purchase and sale agreement between Aziata Bahard and Shatisalal Acharya’s SpectraLite UK was deemed unsuitable to be accepted as it stood. The report recommended further research.

Despite the committee’s recommendations, the government announced it would implement the report but did not make it public or advance the investigation as suggested.

The latest government investigation reveals significant off-book transactions and extensive tax evasion involving certain individuals in the serial purchase and sale of Ncell shares.

The report also highlights violations of Nepal’s Foreign Investment Policy, 2060, underbilling in recent transactions, and questionable financial practices including tax evasion schemes and unreported “Hundi” (illegal transaction) crypto transactions.

According to the report, only NPR 81,160,792 was brought into Ncell as foreign investment, while NPR 66 billion was transferred abroad since the fiscal year 072/73.

The agreement between Aziata Group and SpectraLite UK’s Satislal Acharya included a clause for an additional NPR 10 million payment to Bahard if Smart Telecom was renewed and acquired.

This indicates an ongoing financial relationship between Ncell Aziata and Smart Telecom.

The issue of Ncell’s capital gains tax, which should have been resolved by Supreme Court judgments and international arbitration, has become entangled with connections to top political figures, court-issued stay orders, and government inaction.

Consequently, over NPR 85 billion in taxes owed has not been collected from Ncell.

Despite its consistent profitability compared to other foreign companies, Ncell’s offshore business practices and the lack of a favorable investment environment in Nepal have led to criticism for the state’s failure to address these issues effectively.

Also read:

https://english.khabarhub.com/2024/17/365794/

https://english.khabarhub.com/2024/12/365112/

https://english.khabarhub.com/2024/03/363785/

https://english.khabarhub.com/2024/29/358429/

https://english.khabarhub.com/2024/28/358138/

https://english.khabarhub.com/2024/14/355562/

https://english.khabarhub.com/2024/06/354276/

https://english.khabarhub.com/2024/30/353236/

Comment