KATHMANDU: The weekly Economic Digest offers a concise yet comprehensive and analytical overview of significant business happenings in Nepal, presented in easily digestible summaries.

Gold market rollercoaster: Record highs, volatility, and insights

The recent rollercoaster journey of Nepal’s gold market encapsulates a week of intense price swings, showcasing the complex interaction between economic forces and investor sentiment.

Beginning with a bullish surge on Sunday, followed by corrections and a notable decline on Tuesday, the market displayed susceptibility to various influences. Wednesday saw renewed optimism with a significant increase, suggesting restored investor confidence or speculative activity.

Thursday marked the peak of volatility, witnessing a remarkable surge and setting a new weekly record high. The record-breaking climb to Rs 140,900 per tola on Sunday (May 15, 2024) signals a significant moment in the precious metals market, reflecting shifting investor perceptions and economic conditions.

Moreover, the simultaneous rise in both gold and oil prices, domestically and internationally, over the past year underscores broader economic trends. Gold’s 17.2 percent surge to $2401.50 per ounce, fueled by geopolitical tensions and economic uncertainty, underscores its status as a safe-haven asset amid global instability.

Tej Ratna Shakya, former President of Federation of Nepal Gold and Silver Dealers’ Association, credits the increase in local prices to global patterns, highlighting a decrease in local gold demand caused by the escalation in prices.

Oil Prices Surge amid Supply Disruptions and Global Demand Recovery

Oil prices, particularly Crude Oil Brent, saw a 7.6 percent increase to $93.12 per barrel, influenced by supply disruptions and recovering global demand.

These price movements serve as barometers of economic health and highlight the interconnectedness of commodity markets with local and international economies. Monitoring these trends is essential for informed decision-making and mitigating risks in an ever-evolving economic landscape.

Policy agenda: Focus on growth, youth entrepreneurship, and climate action

President Ram Chandra Paudel introduced the government’s policy and program document for the upcoming fiscal year 2081/82 during a joint session of the federal parliament last week.

The document forecasts a robust economic growth rate of 7.3 percent over the next five years, reflecting the government’s commitment to sustainable development.

It prioritizes youth entrepreneurship and innovation, aiming to support microfinance borrowers and provide loans to 1,000 young individuals to start businesses.

Additionally, initiatives include launching an innovation and national startup campaign to foster entrepreneurship. The plan also targets improving human development and reducing poverty, while addressing climate change and disaster risks.

Ambitious financial targets are set, requiring substantial investment of around Rs 11.1 trillion to achieve objectives such as increasing per capita income and reducing inflation.

Nepal’s 16th Plan Outlined: Targets Rs 11.1 trillion investment

The Nepal Planning Commission (NPC) revealed the estimated cost of approximately Rs 11.1 trillion for executing the 16th Plan, emphasizing the need for private sector partnerships to fund its implementation.

Dr. Min Bahadur Shrestha, Vice Chairman of the NPC, provided insights into the plan’s details and assured that acquiring the necessary investment wouldn’t encounter obstacles. NPC Spokesman Yamlal Bhusal reiterated the importance of exceeding the Rs 11.1 trillion mark to fulfill the plan’s objectives, emphasizing the significance of strengthening ties with the private sector to secure financial backing.

The primary approach of the 16th Plan focuses on addressing structural barriers across various developmental aspects to enhance production, productivity, and competitiveness.

Nepal Rastra Bank maintains stability in Monetary Policy Review

The Nepal Rastra Bank (NRB) has chosen to uphold stability in its third-quarter review of monetary policy, refraining from significant alterations. Analytically, the review reveals several key economic indicators and policy decisions.

In terms of government finances, as of the end of Chaitra 2080, both current and capital expenditures have decreased by 8.9 percent and 9.2 percent, respectively, compared to the previous year.

However, revenue mobilization has surged by 9.4 percent, with internal borrowing nearly meeting targets, resulting in a contractionary stance in net public finance operations. This trend suggests a potential rise in public expenditures by the fiscal year’s end.

The review also highlights the liquidity situation in the banking system, which has led to a decline in short-term and long-term interest rates. Key interest rates, such as the weighted average rate of the 91-day Treasury bill and the interbank rate among financial institutions, have significantly decreased. Moreover, commercial banks have experienced reductions in their base rates, deposit rates, and loan rates.

To manage liquidity effectively, the NRB introduced a fixed deposit facility in Falgun 2080, aiming to maintain the interbank rate within the interest rate corridor. Despite economic uncertainties, the NRB has maintained a cautious yet flexible approach in its monetary policy directives, keeping key rates and ratios unchanged while reviewing provisions for liquidity management and capital strengthening.

Notably, the review introduces measures to strengthen the capital base of banks and financial institutions, including facilitation for additional instruments and adjustments in risk weights and loan loss provisions. Furthermore, provisions allowing the sale of primary capital investments and extension of loans for home purchases demonstrate the NRB’s responsiveness to evolving economic conditions.

However, the NRB’s stance on share margin financing remains unchanged, despite investor demands for policy adjustments. This indicates a cautious approach by the central bank in managing risks associated with share-backed loans.

Overall, the review underscores the NRB’s commitment to maintaining stability and fostering resilience in Nepal’s financial system amidst evolving economic challenges.

Share Market Analysis: NEPSE surges amidst regulatory changes

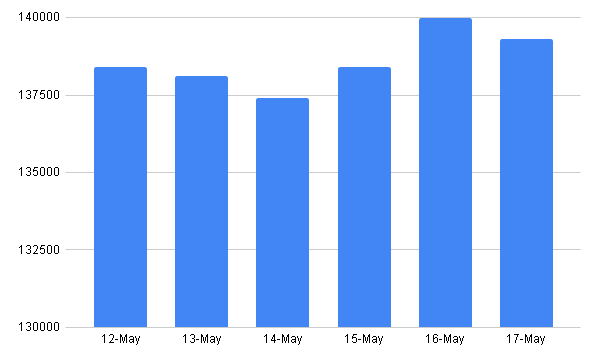

The week of 12th to 17th May, 2024, proved to be a tumultuous period for the Nepal Stock Exchange (NEPSE), marked by a series of notable fluctuations in its index. The trading sessions exhibited a mix of gains and losses, presenting investors with a challenging landscape to navigate.

Kicking off the week on Monday, NEPSE surged by an impressive 24.39 points, reaching a high of 1,998.89 points. This bullish momentum continued into Tuesday, where the index recorded a substantial gain of 28.62 points, settling at 2,027.51 points. However, the market sentiment took a downturn on Wednesday, witnessing a significant loss of 9.54 points, closing at 2,017.97 points.

Thursday saw a marginal recovery with a minimal gain of 0.79 points, ending at 2,018.76 points. The week concluded on Friday with a modest increase of 13.52 points, hitting 2,030.57 points. These fluctuations were driven by various factors, including regulatory changes such as the Securities Board’s reduction in broker commissions and economic indicators like fluctuating bank interest rates.

Despite the overall resilience demonstrated by NEPSE in maintaining relative stability by the week’s end, the inconsistency in performance raises concerns about the market’s stability and predictability.

Additionally, the sectoral analysis revealed a diverse landscape, with winners and losers emerging across industries. Notably, while gains were observed in life insurance, hotels and tourism, trading, manufacturing, finance, and non-life insurance sectors witnessed losses.

Amidst this volatility, investors are urged to adopt a cautious and vigilant approach, closely monitoring market trends and regulatory developments to make informed investment decisions.

Foreign Exchange Reserves Reach Record 19 Trillion Rupees

Nepal achieved a new milestone with its foreign exchange reserves reaching a record 19 trillion 11.86 billion rupees. This growth, a 24.2 percent increase in March, reflects a sustained upward trend driven by rising remittance inflows and a decline in imports.

The consistent increase in reserves each month indicates a robust inflow of foreign currency, primarily from remittances sent by Nepalese working abroad.

This suggests a strong reliance on remittances as a vital component of the country’s foreign exchange earnings.

The reserves have grown substantially from their level in June 2018, which was 15 trillion 39 billion rupees. This growth highlights the effectiveness of economic policies aimed at boosting foreign exchange reserves over the past years.

Nepal Rastra Bank Governor Mahaprasad Adhikari’s remarks emphasize the strength of the external sector and the availability of liquidity for economic initiatives.

Overall, the record-setting foreign exchange reserves position Nepal favorably in terms of economic stability and growth potential.

Comment