KATHMANDU: Last week, Nepal’s provinces unveiled their budgets totaling Rs 300 billion for fiscal year 2024/25, emphasizing decentralized governance and fiscal autonomy with significant allocations for equalization grants and local governments.

On the other hand, gold prices in the country remained stable with slight fluctuations, reflecting global trends, while the NEPSE index showed volatility amid mixed market sentiments.

Likewise, the government also introduced VAT reforms to strengthen oversight and support small businesses, alongside approving a 40 MW electricity import deal with Bangladesh via India.

Meanwhile, the government is poised to pass a Rs 1.86 trillion national budget on June 21st, focusing on economic growth and sectoral development, underscoring its commitment to fiscal responsibility and regional energy cooperation.

These developments underscore Nepal’s stance in managing its economy, promoting regional cooperation in energy, and implementing reforms to foster sustainable growth and development.

Provinces unveil fiscal budget 2024/025

All seven provinces in Nepal unveiled their budgets for the fiscal year 2024/25, a significant annual event that outlines each province’s financial priorities and allocations.

Previously, the combined budget for these provinces amounted to Rs 300 billion for the current fiscal year, indicating substantial financial planning and distribution across regions.

The allocation included Rs 60 billion for fiscal equalization grants to provinces and Rs 88 billion for local governments, emphasizing decentralized governance and fiscal autonomy mandated by constitutional provisions.

The country’s fiscal landscape for the fiscal year 2024/25, has been outlined by the unveiling of budgets across all seven provinces, collectively amounting to Rs 300 billion. This annual event is pivotal as it sets the stage for each province to prioritize and allocate funds according to their specific developmental needs.

The allocations include Rs 60 billion for fiscal equalization grants to ensure balanced development across regions, and Rs 88 billion designated for local governments, underscoring Nepal’s commitment to decentralized governance as mandated by its constitution.

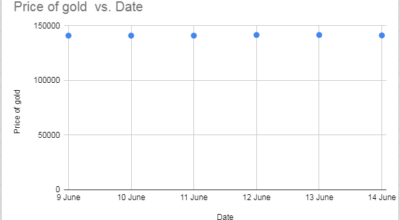

Gold prices maintain stability with minor weekday fluctuations

Gold prices in Nepal showed resilience throughout the week of June 9th to June 14th, 2024, starting at Rs 141,000 and maintaining stability until midweek. A slight uptick to Rs 141,600 midweek was followed by a decline to Rs 141,200 by week’s end, reflecting moderate market fluctuations possibly influenced by global economic trends and local demand dynamics.

Throughout the week of June 9th to June 14th, 2024, the price of gold in Nepal remained relatively stable, with minor fluctuations observed towards the latter part of the week.

However, on Wednesday and Thursday, the price saw a slight increase to Rs 141,600, marking the highest point of the week.

This uptick was likely influenced by global market trends or local demand factors. Interestingly, by Friday, the price of gold dropped to Rs 141,200, indicating a swift adjustment or profit-taking in response to earlier gains.

The consistent level of Rs 141,000 at the beginning of the week followed by fluctuations and a subsequent decline by the end suggests a nuanced market behavior where initial stability gave way to moderate volatility. Such patterns are crucial for investors and stakeholders in Nepal’s gold market to monitor, reflecting broader economic conditions and investor sentiment impacting gold prices locally.

NEPSE index shows volatility

The Nepalese stock market, represented by the NEPSE index, exhibited a week of mixed performances with initial gains followed by a slight pullback. Starting at 2073.19 points, the index peaked at 2115.24 points midweek before settling at 2112.29 points by Thursday, showcasing the market’s sensitivity to both domestic economic conditions and global market movements.

The index demonstrated varied movements throughout the week, reflecting fluctuating market sentiments and economic influences.

Monday saw a reversal in fortunes with the index rising to 2082.09 points, marking a positive absolute change of 8.90 points or 0.42%. This upward trend continued on Tuesday as the index surged to 2115.24 points, showing a significant increase of 33.15 points or 1.59%.

Midweek on Wednesday, the index moderated slightly to 2121.62 points, with a minor absolute change of 6.37 points or 0.30%. However, by Thursday, the index retreated to 2112.29 points, registering a decrease of -9.32 points or -0.43%.

Overall, the NEPSE exhibited a week of mixed performances characterized by initial gains followed by a slight pullback, reflecting dynamic market conditions and investor reactions to both local and global economic factors influencing Nepal’s stock exchange.

Govt implements VAT reforms to strengthen oversight, support small businesses

On the fiscal policy front, the government introduced VAT reforms aimed at enhancing oversight and supporting small businesses. These reforms include the mandatory inclusion of Harmonized System (HS) codes on VAT invoices for imported goods, alongside adjustments in VAT thresholds for service-oriented enterprises.

These measures are designed to bolster tax compliance and curb illicit trade practices, thereby fostering a more transparent business environment.

The government’s directive requires traders to incorporate Harmonized System (HS) codes on VAT invoices for imported goods, aimed at bolstering oversight and minimizing illicit trade activities. Concurrently, the threshold for VAT obligations in service-oriented businesses has been raised from Rs 2 million to Rs 3 million annually, impacting collaborative trade ventures.

Meanwhile, VAT regulations for transportation and merchandise enterprises remain unaltered, necessitating registration for transactions exceeding Rs 5 million per annum. This initiative is part of broader efforts to bolster tax adherence while alleviating operational burdens for smaller firms.

The amendment underscores a strategic push to bolster monitoring of imported commodities within the domestic market and mitigate illicit trade practices.

Bangladesh approves 40 MW electricity import deal from Nepal via India

Bangladesh’s cabinet has approved the import of 40 MW of electricity from Nepal for five years at a rate of 8.17 Bangladeshi Taka per unit. The electricity will be transmitted via the Indian grid, following previous agreements.

This decision signals further energy cooperation, including potential investments in Nepal’s hydropower projects. Bangladesh also plans to purchase up to 9,000 MW of electricity from Nepal by 2040. Bilateral talks are underway to finalize trilateral energy trade agreements involving India.

Government prepares to pass budget on June 21

The government is set to endorse the budget for the upcoming fiscal year on June 21. According to the schedule prepared by the Federal Parliament Secretariat, the budget will be passed on the stipulated date.

Finance Minister Barsaman Pun presented the budget of Rs 1.86 trillion on May 28. The government is currently engaged in ministry-wise discussions of the Appropriation Bill.

Foreign currency exchange rates

Nepal Rastra Bank has set today’s (Monday) foreign currency exchange rates. The US dollar remains unchanged from the weekend, with a buying rate of 133.40 NPR and a selling rate of 134 NPR. Most other currencies have decreased in value.

The Euro now has a buying rate of 142.76 NPR and a selling rate of 143.41 NPR, compared to yesterday’s 143.40 NPR. The British Pound’s buying rate is 169.23 NPR and the selling rate is 169.99 NPR, down from 170.27 NPR.

The Australian Dollar’s buying rate is 88.25 NPR and the selling rate is 88.65 NPR, slightly down from 88.67 NPR. The Kuwaiti Dinar has a buying rate of 434.85 NPR and a selling rate of 436.81 NPR, slightly lower than yesterday’s 436.88 NPR.

Similarly, the Bahraini Dinar has a buying rate of 353.89 NPR and a selling rate of 355.84 NPR, down from 355.50 NPR.

(Prepared by Srija Khanal)

Comment