KATHMANDU: Between August 5th and August 8th, the NEPSE index exhibited high volatility, initially rising to 2,796.38 before falling to 2,651.32, then recovering slightly to 2,766.38, reflecting unstable market conditions.

Concurrently, gold prices in Nepal experienced fluctuations, starting at Rs 149,700, peaking at Rs 150,000, but then declining to Rs 146,300 before ending at Rs 148,100.

In the commercial banking sector, a mixed performance was reported for Q4 FY 2080/81, with some banks showing significant profit increases while others faced declines.

Social security allowances in Nepal have surged nearly 11-fold over the past decade, putting fiscal pressure on the government.

The World Bank has approved $100 million for improving Nepal’s local road infrastructure, and the country is also set to start exporting electricity to Bangladesh later this year, pending a formal trade agreement.

NEPSE index experiences sharp fluctuations

During the week of August 5th to August 8th, the Nepal Stock Exchange (NEPSE) index displayed significant volatility, reflecting sharp market shifts.

On August 5th, the index opened at 2,796.38, marking a gain of 40.76 points or 1.47%, indicative of initial positive market sentiment.

However, this upward momentum was short-lived as the index plummeted to 2,651.32 on August 6th, a steep decline of 145.05 points or 5.18%, likely driven by adverse market news or investor concerns.

The index rebounded on August 7th, reaching 2,759.67 with an increase of 108.35 points or 4.08%, signaling a potential recovery or renewed investor confidence.

The modest rise continued into August 8th, with the index climbing slightly to 2,766.38, reflecting a marginal gain of 6.70 points or 0.24%.

This week’s fluctuations highlight the NEPSE’s susceptibility to rapid shifts in market sentiment and underscore the importance of monitoring both domestic and international factors influencing investor behavior.

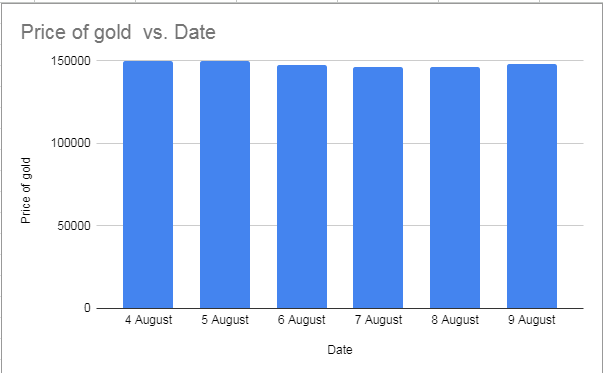

Gold prices experience volatility amid market shifts

In the week of August 4th to August 9th, gold prices in Nepal exhibited notable volatility, reflecting broader market dynamics.

Starting at Rs 149,700 on August 4th, the price saw a modest increase to Rs 150,000 the following day, suggesting a brief period of market optimism or heightened demand.

However, this was short-lived, as prices fell sharply to Rs 147,700 by August 6th, likely influenced by shifts in market sentiment or external economic factors.

The downward trend continued, reaching Rs 146,300 on August 7th, before experiencing a slight recovery to Rs 146,600 on August 8th.

On August 9th, the price climbed to Rs 148,100, possibly reflecting a stabilization phase or renewed investor interest.

The week’s fluctuations underscore the sensitivity of gold prices to market sentiment and external economic variables.

Commercial banks report mixed performance in Q4 FY 2080/81

In the fourth quarter of the fiscal year 2080/81, twenty commercial banks reported a collective net profit of Rs 64.15 billion, according to unaudited financial statements.

Nabil Bank led the profit rankings with Rs 7.06 billion, marking a 10.23% year-on-year increase.

Global IME Bank and Nepal Investment Mega Bank followed with profits of Rs 6.01 billion and Rs 5.19 billion, respectively.

At the lower end, Machhapuchhre Bank posted the smallest profit of Rs 1.25 billion, while Citizens Bank International and NIC Asia Bank each reported around Rs 1.3 billion, and Nepal Bank earned Rs 1.65 billion.

Notably, Prabhu Bank achieved the most impressive growth with a staggering 1499.04% increase in net profit, with Kumari Bank, Prime Commercial Bank, and Agriculture Development Bank also seeing substantial rises of 345.67%, 267.19%, and 176.23%, respectively, due to adjustments in the previous fiscal year’s financial statements.

In contrast, ten banks faced declines in net profit, with NIC Asia Bank experiencing the steepest drop of 68.91%, followed by Nepal Bank at 51.80% and Citizens Bank International at 27.97%.

Nepal’s social security allowances surge nearly 11-fold in a decade

Over the past decade, social security allowances in Nepal have experienced a dramatic increase, growing nearly 11-fold due to political initiatives aimed at enhancing old-age benefits and gaining electoral favor.

Allocations for these allowances surged from Rs 12.99 billion in FY 2013/14 to Rs 142 billion in FY 2023/24, with expenditures rising from Rs 10.95 billion to Rs 116 billion over the same period.

Despite stagnant government revenue and a constrained development budget, social security now accounts for 8.16% of the total budget, up from 2.51% a decade earlier.

This expansion has placed significant fiscal strain on the government, with social security costs nearing a quarter of total revenue.

The program, which has been broadened by successive administrations, includes beneficiaries who also receive pensions from foreign countries like India and the UK, leading to continued instances of double benefits despite regulatory efforts.

For FY 2024/25, the government has allocated Rs 298.57 billion for social security, encompassing a range of programs beyond just allowances.

However, the rising costs and expanding coverage are increasingly challenging the government’s fiscal sustainability.

World Bank approves $100 million for Nepal’s provincial and local road network enhancement

The World Bank has sanctioned $100 million in aid for Nepal’s Provincial and Local Road Network Improvement Program, funded by the International Development Association (IDA).

This grant will be directed towards upgrading and constructing local road infrastructure in the Sudurpaschim, Karnali, and Madhesh provinces.

The initial phase of the project is set to develop and improve 3,000 kilometers of roads, aiming to benefit approximately one million residents.

The program is anticipated to enhance connectivity, efficiency, and safety, while also bolstering local government capacity in road and bridge management.

The funding agreement was recently finalized by Nepal’s Finance Secretary, Dr. Ram Prasad Ghimire, and World Bank Country Director David Sislen.

Nepal to launch electricity exports to Bangladesh this year

Nepal is preparing to begin exporting electricity to Bangladesh later this year, as announced by Kulman Ghising, Managing Director of the Nepal Electricity Authority (NEA).

In a speech commemorating the third anniversary of his second term, Ghising highlighted significant progress in Nepal’s energy sector, noting that over Rs 100 billion has been invested in electricity production and distribution.

NEA’s revenue has also exceeded Rs 100 billion.

The export plan will involve transmitting electricity through India, with a formal trade agreement contingent on resolving the ongoing crisis in Bangladesh.

(Prepared by Srija Khanal)

Comment