KATHMANDU: Last week’s economic updates showcased a landscape marked by volatility and strategic planning. Gold prices fluctuated throughout the week, responding to global instability, geopolitical tensions, and monetary policy shifts.

The Nepalese stock market mirrored this volatility, with the NEPSE index experiencing fluctuations amidst economic uncertainties.

Meanwhile, Nepal unveiled its new fiscal budget for 2024/025, emphasizing economic reforms, sectoral growth, and social welfare. Finance Minister Barshaman Pun projected a 6% economic growth rate for the upcoming fiscal year, highlighting the need for collaborative efforts between the government and the central bank.

Additionally, Nepal’s decision to export electricity to India underscored advancements in the energy sector and regional cooperation. These updates reflect a nuanced approach to economic management amidst dynamic global conditions.

Government unveils Rs. 1.86 trillion budget for Fiscal Year 2024/025

Finance Minister Barshaman Pun oversees the allocation of a Rs. 1.86 trillion budget, with 61.31% earmarked for recurrent expenditures, 18.95% for capital expenditures, and 19.65% for financial management in the 2024/025 fiscal budget.

To finance these expenditures, the government aims to generate Rs. 1.26 trillion from tax revenues, with a revenue target of Rs. 1.2 trillion for the current fiscal year. Additionally, Rs. 330 billion will be sourced from internal borrowing, Rs. 270 billion from external borrowing, and Rs. 5.23 trillion from foreign grants.

Targeting a 6% economic growth rate, the government emphasizes sustainable development and sectoral expansion, aiming to maintain inflation at 5.5% to ensure price stability and protect consumer purchasing power.

Finance Minister projects 6% economic growth rate

Finance Minister Barshaman Pun projected a 6 percent economic growth rate and a 5.5 percent inflation rate for the upcoming fiscal year. He emphasized that achieving this growth target would require collaboration between the government and the Nepal Rastra Bank, with the central bank formulating complementary monetary policies.

The Finance Minister expressed optimism that the implementation of the budget would accelerate economic activities, leading to sustainable growth, increased production, and job creation. However, he acknowledged that economic growth for the current fiscal year is likely to be 3.9 percent, falling short of the 6 percent target due to slower-than-expected expansion of economic activities.

Gold prices swing amid global instability

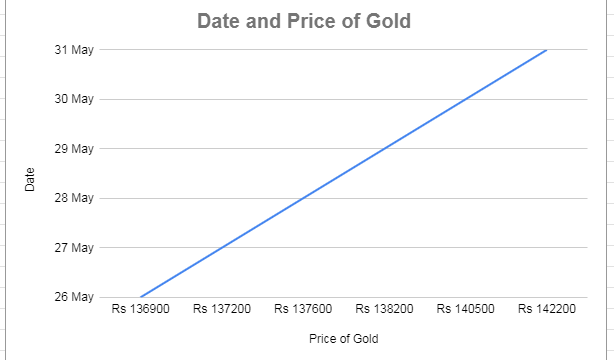

Throughout the week spanning from 26th May to 31st May, gold prices experienced notable fluctuations, indicative of a market grappling with uncertainty and risk. Starting at Rs 136,900 on Sunday in the Nepali market, the modest uptick to Rs 137,200 on Monday reflected tepid investor sentiment amid ongoing geopolitical tensions and trade uncertainties.

However, the subsequent incremental rise to Rs 137,600 on Tuesday suggested a cautious optimism as investors sought refuge in safe-haven assets amidst a backdrop of escalating global trade disputes.

Wednesday’s more pronounced increase to Rs 138,200 underscored growing concerns over geopolitical instability and dovish monetary policy stances by major central banks. Thursday witnessed a significant surge to Rs 140,500, highlighting investors’ heightened anxiety and a flight to safety amid mounting geopolitical risks.

The week culminated with gold prices soaring to Rs 142,200 on Friday, propelled by a combination of geopolitical tensions, expectations of interest rate cuts, and a weakening US dollar. However, despite these gains, gold prices remain susceptible to volatility, contingent upon evolving geopolitical dynamics, central bank policies, and trade negotiations.

This price movements underscore the delicate balance between risk and uncertainty in global markets, warranting cautious observation and strategic positioning by investors.

NEPSE’s weekly performance reflects volatility

Throughout the week of 26th May to 30th May, the NEPSE index experienced a rollercoaster ride, reflecting the market’s susceptibility to a myriad of internal and external factors.

Despite opening with a significant downturn on Sunday, shedding 22.14 points or 1.03%, the index managed to recover slightly on Monday, gaining 3.93 points or 0.18%, only to plunge once again on Wednesday by 23.81 points or 1.12%.

Thursday witnessed further decline, with the index dropping by 19.89 points or 0.95%. These fluctuations underscore the fragility of investor confidence amidst lingering economic uncertainties and external market pressures.

While sporadic rebounds hint at fleeting optimism, the overall trend reflects prevailing caution and skepticism among investors, perhaps fueled by concerns over domestic economic indicators, corporate performance, and global market volatilities.

As the Nepalese stock market navigates through choppy waters, stakeholders are reminded of the importance of vigilance, strategic planning, and a nuanced understanding of market dynamics in navigating the uncertainties ahead.

New Fiscal Budget 2024/025 unveils holistic economic strategy

Outlined in the new fiscal budget 2024/025, a comprehensive strategy emerges, encapsulating five strategic priorities designed to invigorate economic vitality: spearheading economic reforms and bolstering private sector advancement, prioritizing key sectors like agriculture, energy, information technology, tourism, and industrial growth, while strengthening the social fabric through targeted investments in education and healthcare, ensuring inclusivity and social welfare via robust social security measures, and elevating governance standards alongside refining public service delivery mechanisms.

Concurrently, the budget delineates five economic reform strategies encompassing the implementation of structural reforms for systemic enhancement, fostering a conducive business environment to spur growth and innovation, revamping the public finance system for fiscal stability and transparency, undertaking comprehensive reforms in the financial sector to bolster resilience, and modernizing public administration for efficiency and effectiveness.

These strategies converge with five transformative sectors, aiming to revolutionize agriculture for sustainable growth, propel energy towards self-sufficiency and innovation, foster advancements in information technology to drive digital transformation, promote tourism as a driver of economic prosperity, and cultivate entrepreneurship and industrial development for economic diversification. Such an integrated framework, outlined within the new fiscal budget, seeks to address multifaceted challenges, leverage opportunities, and pave the way for inclusive and resilient economic development.

Nepal’s electricity export to India signals energy sector advancement

The decision to export around 400 megawatts of electricity to India daily represents a significant milestone in the energy collaboration between Nepal and India, showcasing Nepal’s ability to utilize its natural resources to fulfill its own energy requirements while also aiding its neighbor in meeting its energy demands.

This export signifies a notable transformation in Nepal’s energy sector, highlighting enhanced production capacities and potential economic advantages through energy trade. By capitalizing on its abundant hydropower resources, Nepal not only addresses its domestic energy needs but also contributes to regional energy security and economic advancement.

This export-oriented strategy, coupled with ambitious objectives for future expansion, underscores Nepal’s dedication to sustainable energy development and the utilization of its natural assets for the betterment of both national and regional interests.

Over half a million foreign tourists visit Nepal in five months

Nepal has seen a surge in tourism over the past five months, welcoming over half a million foreign visitors, though May’s figures saw a slight dip to 90,211. India leads with 148,861 tourists, followed by China and the United States.

However, fluctuating monthly numbers highlight vulnerabilities in the sector, raising questions about sustainability and diversification strategies. Key metrics such as expenditure and length of stay remain undisclosed, essential for gauging tourism’s economic impact and guiding future planning. Nepal must adopt a nuanced approach to address fluctuations, diversify visitor sources, and bolster sector resilience for sustained growth and community benefit.

Gold prices retreat after record highs

Gold prices, after reaching record highs, experienced a notable decline on Sunday, dropping by Rs 200 per tola. According to the Federation of Nepal Gold and Silver Dealers’ Associations, the trading price of gold for Sunday settled at Rs 142,000 per tola, down from Rs 142,200 per tola on Friday.

Similarly, the price of standard gold also saw a decrease, now standing at Rs 141,300 per tola. This downward trend follows a consistent decline in silver prices over the past three days, with a drop of Rs 25 per tola compared to Friday.

Sunday’s trading price for silver is Rs 1,850 per tola, down from Rs 1,875 per tola at the end of the previous week. This shift indicates a potential easing in demand for precious metals, reflecting evolving market dynamics and investor sentiment.

(Prepared by Srija Khanal)

Comment