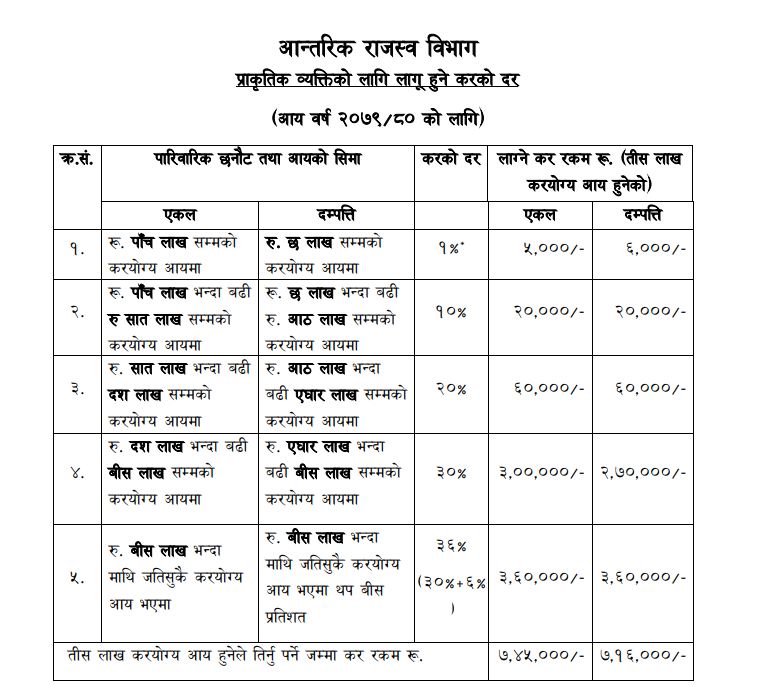

KATHMANDHU: The Inland Revenue Department (IRD) has made public the tax rates to be paid in accordance to changes made in the tax structure proposed by the budget for the upcoming fiscal year.

According to IRD, unmarried and married people have to pay only one percent tax on income up to Rs 500,000 and Rs 600,000 respectively. This means a single individual has to pay Rs 5,000 and couples Rs 6,000 if their taxable incomes are within aforementioned tax slab.

Similarly, unmarried individuals earning Rs 500,000 to Rs 700,000 and couples earning Rs 600,000 to Rs 800,000 should pay 10 percent or Rs 20,000 as tax.

Likewise, unmarried individuals with a taxable income of more than Rs 700,000 and up to Rs 1 million, and couples with a taxable income of Rs 800,000 to Rs 1.1 million have to pay the same tax of 20 percent i.e. Rs 60,000.

Similarly, for single individuals earning more than Rs 1 million up to Rs 2 million, 30 percent or Rs 300,000 will be taxed. And, for couples earning taxable income of Rs 1.1 million to Rs 2 million, 30 percent or Rs 270,000 will be taxed.

Similarly, those earning more than Rs 2 million should equally pay 36 percent i.e. Rs 360,000 in taxes, according to a statement released by the department on Tueday.

According to IRD, an individual and a couple earning more than Rs 3 million taxable income have to pay Rs 745,000 and Rs 716,000 in taxes respectively.

Comment