0%

Background

The Government of Nepal has been practicing a non-contributory pension scheme for a long time now, in which the entire pension and gratuity obligation is covered by annual government budget allocations. The contributory pension scheme, however, has been enforced since 2075 BS.

According to the International Labor Organization (ILO), social security is the protection which society provides for its members through a series of different programs.

The first pension scheme was introduced in Nepal particularly for the Nepal Army personnel on 17th Bhadra 1998 BS. This was the first social security scheme of Nepal. Then, the pension was 1/5th of the last salary paid.

Eventually, the pension for civil servants was established on 14th Mangsir 1999 BS. The pension amount was 1/6th of the salary with a minimum of 25 years’ service for eligibility.

Civil servants currently require at least 20 years of service to be eligible for pension throughout their life.

Likewise, the amount of pension for civil servants is supposed to be not less than 50% of their basic salary and not more than 100%, depending upon the length of service, last drawing salary and the denominator.

A non-contributory social pension scheme was introduced in 1995 BS which provides allowances to elderly citizens, aged 75 years (now 70) and above. Similarly, the allowance was also provided to widows aged 60 and above.

Likewise, after the death of a pensioner, their spouses would be compensated with a pension for the remainder of their lives. According to the Pension Management Office, a total of 47,674 recipients of the pension are/were the pensioner’s spouse to date.

The Pension Management Office is the official institution, which handles the record of retired employees, and is responsible for paying the monthly pension amount to Civil servants, police, army and teachers.

The Office has been distributing monthly pensions to retired civil staff, police, army and teachers through more than 250 branches of various commercial banks across the country.

Pension Beneficiaries and Annual Pension Increment in Nepal

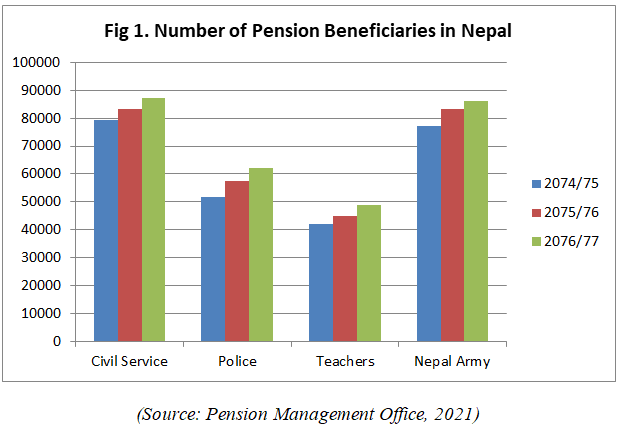

Pensions are being given to civil servants, army and police personnel and teachers. The following graph illustrates the number of pensioners from the Fiscal Year (FY) 2074/75 B.S. to 2076/77 B.S. There is no doubt that the amount of pension and the number of pensioners are growing around the board.

The figure shows that the number of pensioners is on the rise every year. While the hike in the number of pensioners for the civil service tips the list, the hike in the number of pensioners of teachers remains to be the lowest.

One of the reasons behind this is the difference in the retirement ages; the retirement age for civil service officials is 58 whereas for the teachers it is 63. The other reason is that most of the teachers are appointed on a temporary basis.

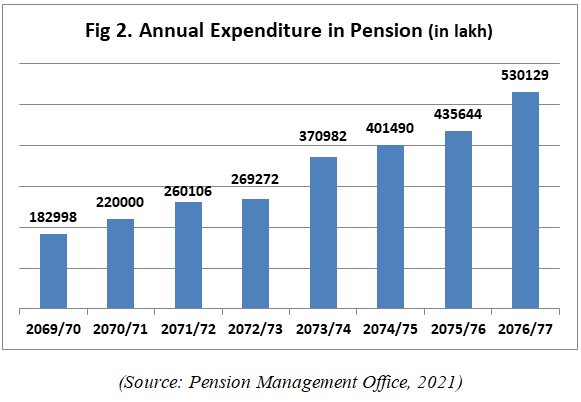

Figure 2 represents the government’s annual expenditure in pension from FY 2069/70 B.S. to FY 2076/77 B.S. Here, we can see that the amount of increment in pension is increasing every year.

The figure illustrates that the year 2076/77 has seen the all-time high pension amount that is NRs. 53 arab 1 crore 29 lakh. We can see a difference in total NRs. 9 arab 44 crores 85 lakh. The pension liability is increasing.

A total of 67.5 million is allocated for social security in the national budget for FY 2077/78. This represents about 4.5 percent of the national budget.

Both the number of pensioners and the pension fund liability are increasing every year and if this goes on the same track, it will be difficult for the government to bear this financial burden. It is high time that the government looked into the long-term implications and its contingency liability.

Against the above background, let us take a quick look at all the services where pensions are distributed, their status, and how we can reduce the financial burden of the country.

Civil Service

As discussed above, the retirement age of civil service is just 58 years. Until the 1990 political reform, civil servants could retire at the age of 60. In 1990-91, the government reduced the retirement age to 58. Experts say that top-level officials declined to collaborate with the elected government because they remained loyal to the previous administration. Since then, the problem has not been fixed.

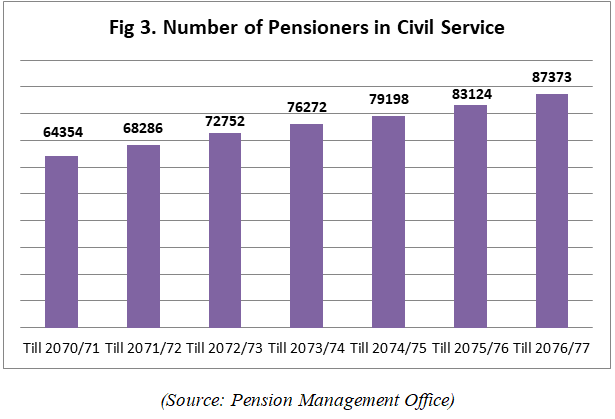

The following figure shows the number of pensioners in civil service from FY 2070/71 B.S. to 2076/77.

The number of pension beneficiaries in civil service is escalating every year. In the past 6 years, the total number of pensioners in civil service has increased from 64,000 to 87,000, i.e. about a 42 percent increase.

This increase in the number of pension beneficiaries directly impacts the government’s financial burden. The government must, therefore, take initiatives to decrease the increment rate and its future financial burden. Civil servants are currently retired at the age of 58, and earn up to 75% of their salary as pension.

While comparing with our neighboring nations, currently, Bangladesh and Nepal are the only two countries in South Asia that have set the retirement age for civil servants below 60. Government workers in Bangladesh must retire at the age of 59.

Here, one of the options now is to extend the retirement age of the civil service workers until 60 (many organizations have done such extension, not only due to pension reasons but also not to lose capable manpower).

Or if a conservative approach is preferred, the extension should be ideally on a selective merit basis. That way only capable officials can contribute substantively to the government. For this, the government must examine the official’s true capability, strength and performance fairly.

At the moment, although the Parliamentary State Affairs and Good Governance Committee has decided to increase the retirement age for civil servants to 60 years from 58, the parliament hasn’t endorsed the bill yet.

Since the bill hasn’t been endorsed yet, there is still an opportunity to consider the options whether to extend the term by two years or by some additional 3-5 years i.e. 63 or 65 years.

Many countries and international agencies have extended their retirement age with variations on the nature of extensions and the associated benefits; hence, a proper review will be useful.

Any new provision for the justification of extending the retirement age should minimize the government’s financial burden, bring uniformity in the retirement age across different civil services, and keep capable manpower needed for the government yet without depriving the energetic youths from joining the service.

The parliament could consider approving the measures to bring uniformity in the retirement age. Currently, Civil servants retire at the age of 58, government-hired health workers and those serving in Parliament retire at the age of 60, government-employed teachers retire at the age of 63, and those working in courts retire at the age of 65. The data justifies the attempts to extend the tenure of civil servants.

Additionally, the government can use civil service workers for few more years at just 25% cost if the retirement age is raised.

Furthermore, since the government invests heavily in civil servant career development, it is rational that the new provision will ensure the government retains experienced civil servants for another two years.

Besides, Nepalese people’s average life expectancy has increased dramatically over time. Life expectancy was around 40 years during the early 1970s and it has now reached 71.1 years.

This will further increase at least by two years till the deadline set for attaining sustainable development goals. This is a clear indication that employees today, can continue to perform efficiently even at an older age than in the past.

Similarly, the retirement age of 58 may be unwanted, especially for women. Women may enter the civil service when they are 40 years old, and civil servants may only earn a pension after 20 years of service. This implies that a woman who joins the civil service at the age of 40 will retire after 18 years, making her ineligible for a pension.

If the government is able to enforce this decision, it can save a significant amount of expenditure in pension-related costs which can be invested in some productive sectors.

Nepal Army and Nepal Police

The whole system of providing pension was started by distributing pension to Nepal Army. Nepal Army is the first-ever institution getting the facility of social security. The number of pensioners in the Nepal Army lies among one of the highest after civil service.

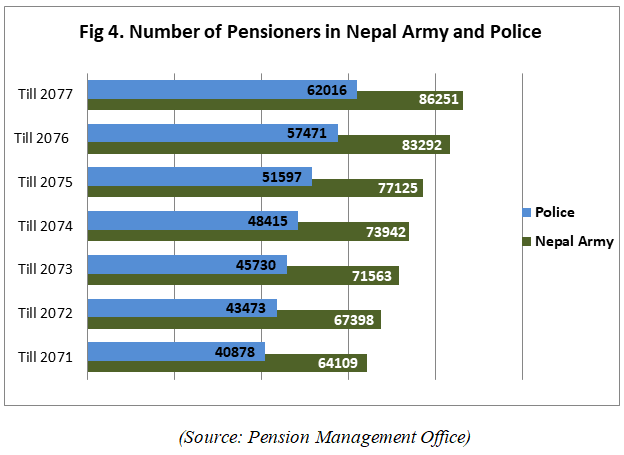

Figure 4 represents the number of pension beneficiaries in the Nepal Army and the Police from the FY 2070/71 BS till FY 2076/77 BS.

Figure 4 shows a drastic increase in the number of pensioners in the Nepal Army and the Police during the time span of just 6 years. According to the statistics, the recent number of pensioners in the Nepal Army is 86 thousand. Similarly, there are 62 thousand pensioners in the Police.

The number of pensioners in the Army is very close to the number of pensioners in civil service. While the number of pension beneficiaries in the Nepal Army is increasing annually, so is the amount of pension.

In Nepal Army, if you don’t get a promotion as a soldier, you will retire in 20 years for your job tenure. This means, if you enter Nepal Army at the age of 20 and don’t get a promotion, you will retire at 40, and then you will be facilitated by a pension.

A similar system is applied in the case of the Nepal Police. This system of retirement at an early age hiked the number of pensioners and the amount to be allocated for that heading.

This system has to be modified to reduce the financial burden. Rather than retiring, the soldiers who don’t get promoted can be utilized by the Army and the Police for general administrative works.

For example, they can be recruited as a staff of petrol pump, security personnel for the chief army and police officers, etc. Likewise, the government of Nepal hires a notable amount of temporary manpower for clerical tasks.

Instead of hiring them and spending on their salary, the government can utilize these retired army/police personnel. In addition to this, these soldiers can also be used for some special purposes like elections.

In this way, they can be retained for work for some more time which will ultimately save a significant amount of money.

Likewise, a pensioner may be provided the full amount of pension after a said age bar. For instance, if a worker retires at his/her age of 40, he/she can be paid pension just 50% of their actual pension amount till 60 and as the said pensioner is capable to actively work in any sector till the age 60. From 60, the pensioner shall be able to receive the full amount of their pension.

Teachers

While comparing the amount of pension and number of pension beneficiaries, the teachers appointed by the government of Nepal come at the lowest.

The number of pensioners in teaching service is almost half of that in the civil service. This is mainly because the government hires temporary manpower in teaching service.

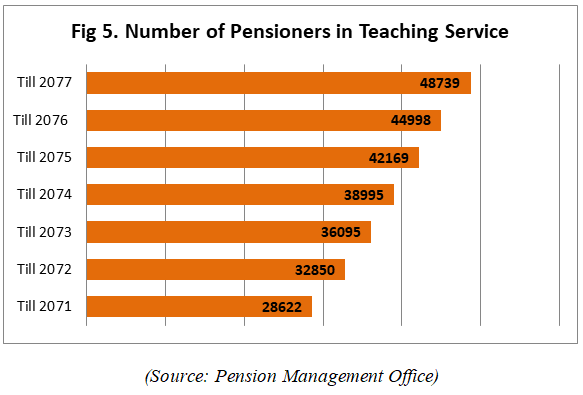

Similarly, the retirement age of teachers is 63 years, which is 5 years more than that of civil service workers. Figure 6 shows the number of pensioners in teaching service from FY 2070/71 BS till FY 2076/77.

The number of pensioners in teaching service is significantly low. In the case of teachers, the retirement age must be extended by 2 years, but they must be given skillful training and workshops to be updated with the present model of the education system.

Many people argue that the aged teachers cannot give their level best as they are not updated with today’s environment. However, if the government provides on-the-job training and skill development programs to teachers, this gap will be filled. This would surely turn out to be a win-win situation for all.

Conclusion

The number of pension beneficiaries is currently on the rise in the country. If the current trend continues, pension beneficiaries will account for a large portion of the overall population in the coming decades, as annual pensioner growth outpaces annual population growth.

The percentage of pension spending in overall expenditure is also significant since such a large amount of public money is being spent on pension management rather than capital raising programs.

Henceforth, the suggestions above deserve serious consideration. While one school of thought says the retirement age of 58 will result in an additional financial burden to the government, the other says increasing the retirement age to 60 or more would mean fewer employment opportunities for the youths. There are convincing arguments on both sides of the debate.

However, it should be noted that especially in civil service, when a person retires at 58, they start working for consultancies, INGOs and other interest groups. All their qualifications are finally used by other organizations which should have been utilized by the government itself.

On the other hand, teachers serving until the age of 63 itself show that civil servants could easily serve till they turned 60 or more. If the government is successful in implementing this decision, it will save billions in annual pension costs which can be invested for development activities and the betterment of society.

Similarly, to raise the fund’s revenue, a portion of the money raised in the pension fund should be invested in megaprojects such as hydropower, fast track, and so on. The profit amount will provide some relief to the government to bear pension costs.

Nepal is committed to achieving sustainable development goals (SDG) by 2030. Early retirement results in gender discrimination. To minimize this and demonstrate government commitment for gender equality, revisiting the retirement age will be considerable.

One of the assumptions of the pension scheme is that as age advances, employees’ productivity and efficiency will reduce. A productive and healthy life period is one of the determinants for retirement age.

Our proverb ‘Sathhi Hathma Lathi and Satari Kuna ma Latri’ is no longer valid now. We can see the people above 65 years still living a productive life. Hence, increased life expectancy can be factored into revisiting the retirement age.

At the moment, the government is responsible for all pension obligations, which is driving up the state’s recurrent spending.

Policymakers should take this issue seriously going forward and make requisite changes for the country’s overall benefit. A credible pension review for the long-term interest of the country is needed at the earliest.