KATHMANDU: Hit hard by the COVID-19 slump coupled with the prolonged lockdown, the majority of Nepal’s business enterprises are experiencing a huge loss – no matter how established the businesses are.

Consequences: Businesses, both large and small, are finding it challenging to keep turning their financial wheels because of the lockdown. Economic environment, especially economic recovery, short and medium terms, is uncertain. Entrepreneurs, therefore, have called on the government to ease the tax compliance burden on them and extend timelines for other duties and bills as a tool of alleviating pressure on them.

The GDP growth rate targeted by the government will not happen, a view already accepted by many. The new GDP growth rate as prescribed by the Central Bureau of Statistics (CBS) is 2.27%, even this has been questioned. Nepal is not the only country facing negative socio-economic impacts; the entire world is combating the COVID-19 and its serious socio-economic impacts with various stimulus packages.

The debt to GDP ratio denotes the total debt of a country as a percentage of GDP. Japan has a debt to GDP ratio of 232.296% which is among the highest in the G20 group and worldwide. The debt to GDP ratio denotes the fiscal space of a country.

In order to overcome the financial loss and boost the country’s economy and society as a whole, several countries have started taking loans, where possible in softer terms from donors and injecting it into the sectors which are losing. Nepal, too, should follow suit, timely action is essential.

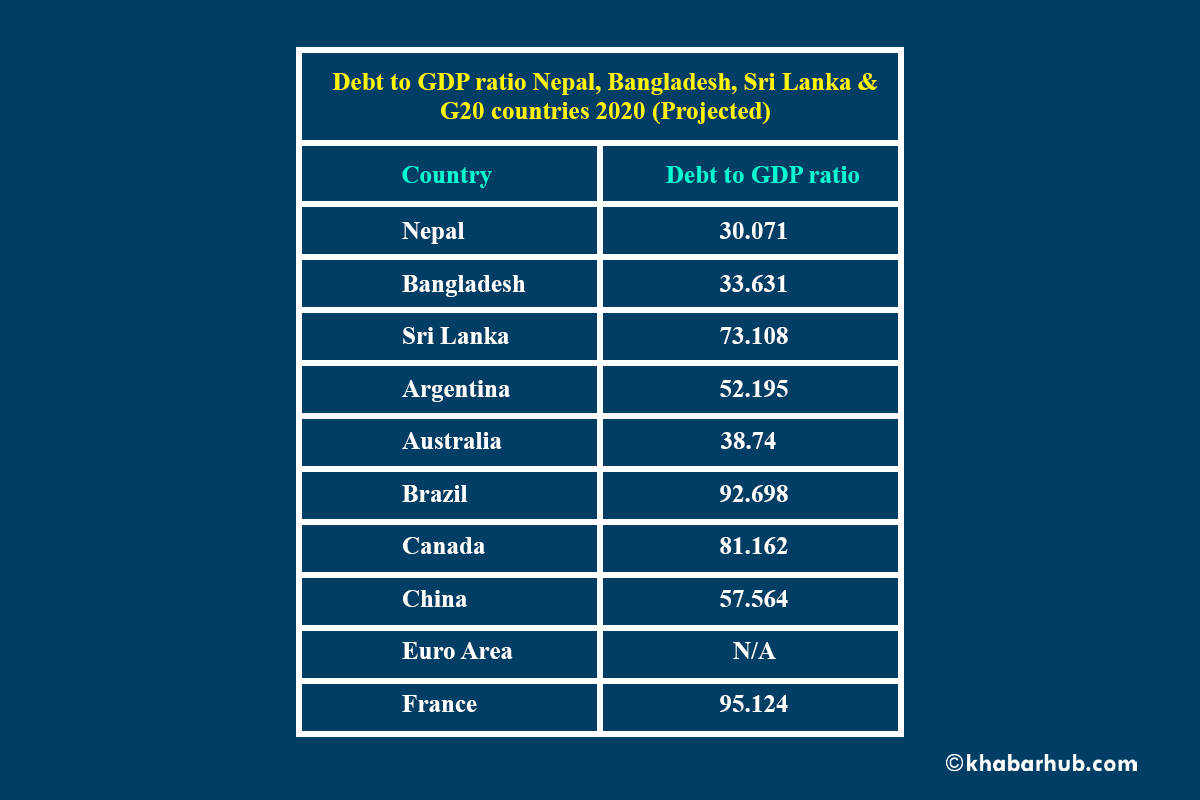

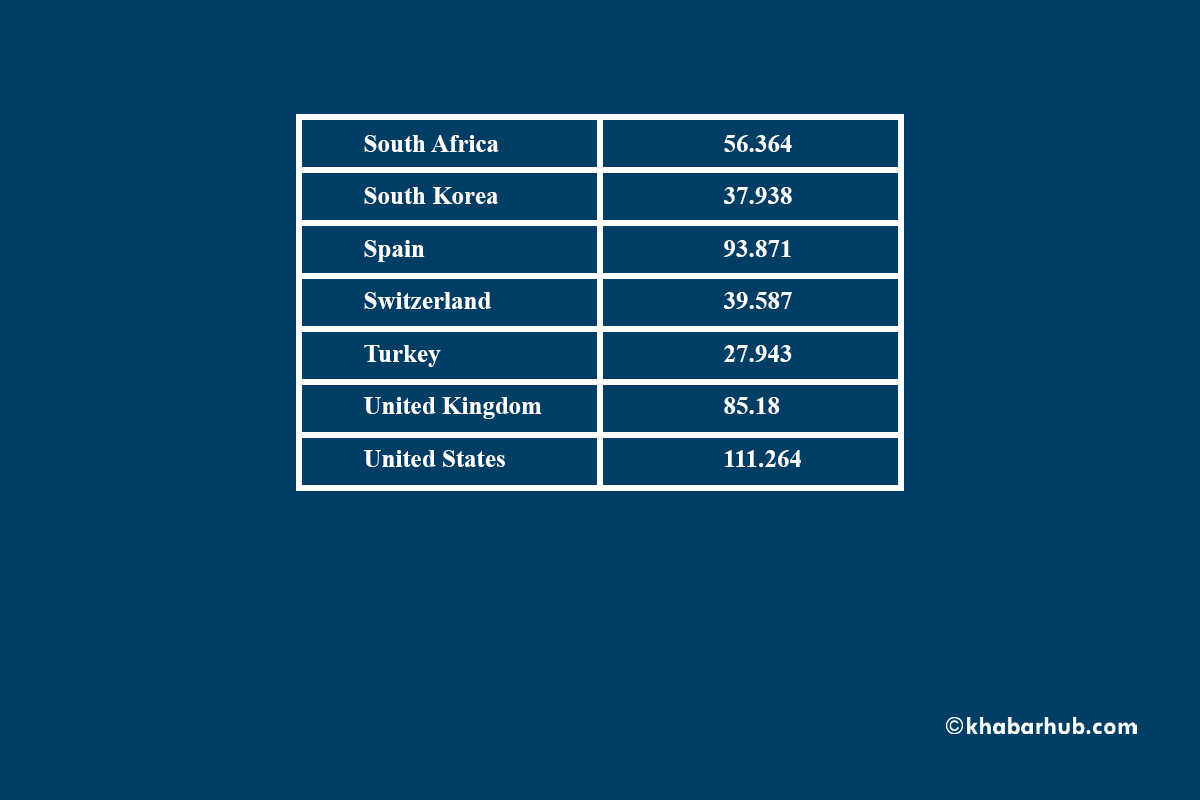

Almost all the G20 countries have recognized the impact of coronavirus and its potential future impact on their economy. The following Table presents the debt to GDP ratio in the World Economic Outlook in 2018 projected by the International Monetary Fund (IMF).

The debt to GDP ratio denotes the total debt of a country as a percentage of GDP. Japan has a debt to GDP ratio of 232.296% which is among the highest in the G20 group and worldwide. The debt to GDP ratio denotes the fiscal space of a country.

Currently, amid the COVID-19 pandemic, Japan’s fiscal stimulus packages have been impressive which is about 21.1 percent of the GDP ( as of May 2020). Japan seems to have taken an approach– “ whatever money takes “ to deal with the crisis. As the projection was done in 2018, the COVID-19 pandemic was not accounted for.

It is expected that, at the end of 2020, the debt ratio will be different, most probably higher than the projections. Due to the pandemic led recession, the GDP of all countries will surely decrease and as a result debt to GDP ratio will be higher even if the debt is not increased.

In order to fight the recession, several countries are most likely to take more loans. However, as the entire world is facing a devastating economic slump, the availability of loans at reasonable terms is itself an issue.

Nepal’s debt to GDP ratio is projected to be 30.071% in 2020. Even with this, Nepal is in a comfortable position to utilize the loans, including the concessional funds from international institutions, for capital formation and expansionary fiscal policy that could include either increasing expenditure or decreasing taxes.

Reducing taxes, where and as relevant should be examined, and increasing government expenditure for capital growth with all the available fiscal space should be considered. Even some recurrent expenditure can be termed as capital expenditure as the categorization sometimes creates confusion.

Construction of a road is termed as capital expenditure but the wages given to laborers that construct the road are categorized as recurrent expenditure. Even though the wages are categorized as recurrent expenditure the wages are creating capital growth.

Similarly, relief packages for the citizens in this time of a pandemic-led economic slump are a recurrent expenditure but utilizing the received relief package on domestic investment and consumption of domestically produced goods will play a role in capital formation.

It has been said that Nepal’s recurrent expenditure is higher than the capital expenditure. However, at the end of the day, the only thing that matters is where and how the money is being spent.

If the salary of a government employee is used for entertainment such as dining at a fancy restaurant not much will be contributed towards capital growth. But instead, if the salary is used to buy a house or invest in a company the capital growth will increase substantially.

The government thus must prioritize bringing plans and policies to utilize, manage, and engage this manpower for increasing productivity and by creating employment.

Coming back to fighting this recession by providing stimulus packages is not only possible but effective. Stimulus packages are basically designed to provide money to individuals and entrepreneurs to increase confidence in the market.

A recession creates cash hoarding as people will have the fear that this will never end and if all their savings are spent in a hollow business, they will not be able to survive.

Entrepreneurs fear that their products will not be consumed, hence reluctant or even refuse to invest. Investment and consumption have to increase to tackle recession.

The confidence to spend creates fiscal growth. Taking additional loans to increase fiscal stimulus in Nepal is definitely a good idea and is needed.

The government requires a reliable need assessment study on the impact of COVID-19 in the Nepalese economy. The sectors impacted the most and the least should be wisely distinguished and relief packages must be allocated accordingly. It is well understood that the remittance this year will be taking a significant decline along with the tourism sector.

Merely putting in all its efforts on short-term development plans or projects will push the country’s economy further down consequently making it difficult for the government to lift the country’s economy aftermath of the crisis.

Among others, Nepal’s tourism sector, which was expected to boom like never before, has faced the heaviest loss as the country was expecting more than 2 million tourists and solid revenue.

Now, a minimum of two years will be required for the tourism industry to get back to normal. Alongside this, a huge number of migrant workers will be returning to Nepal once the lockdown is relaxed or ended.

The government thus must prioritize bringing plans and policies to utilize, manage, and engage this manpower for increasing productivity and by creating employment. Potential sectors such as agricultural sectors shall be revitalized where this manpower can be engaged.

Hence, while developing a relief package, the government needs to prioritize these sectors. In order to provide a strong relief package and inject money in the economic sector, Nepal requires a loan of at least 5% of its GDP, which the donors like IMF, World Bank, ADB and others as well as its limited internal resources, can provide in this difficult situation.

Moreover, the government must make sure that the loan is being injected rationally in the required economic sectors. If the government is to be serious about this, soon or later Nepal will recover the economic loss and proceed to the path of development.

(With inputs from Swastik Aryal)

Comment