Recently, few questions have emerged on the pegging of Nepali currency to Indian currency.

Questions like: Is it a correct policy to peg with the Indian currency?

Whether the Nepali currency should adopt a floating currency exchange? Or should Nepali currency be pegged with another currency and other related questions? These are important and serious issues and require serious thinking and analysis.

Hope these questions are NOT (repeat NOT) raised at this time when there are both diplomatic and political issues with India.

Right at the outset, we feel that to raise such a serious issue that requires wisdom and knowledge from professionals and experts in monetary policy, with any political mindset is WRONG and should not be done.

Having said this, let us look at this issue with some analytical thinking and by asking a few questions.

What makes a currency strong?

Generally, a currency is said to be strong by considering the demand of the currency along with the gold deposit of the country’s central bank.

A currency is classified as strong when it is worth more than other country’s currency. In other words, for illustration, if the Indian currency is worth half the US dollar, the dollar would be considerably stronger than the Indian currency.

If the inflow of foreign currency in a country is greater than the outflow, then the said country’s currency will be stronger and vise-versa.

Similarly, most people hold myths related to the strong currency that if a country produces more cash the currency gets stronger.

Fixed versus Floating Currency: What is better for Nepal?

Many countries follow either a fixed exchange rate or floating exchange rate or both. In fact, various methods of interest rates are determined by merging fixed and floating exchange rates.

Under the international monetary system, the Gold Reserve System was accepted in 1816-1914 as gold parity. Breton Woods System accepted Pegged Exchange Rate from 1944 to 1971.

And, Dollar System with a flexible exchange rate was introduced in 1971.

A fixed exchange rate or a floating exchange rate determines the value of a currency. A floating exchange rate is determined by the open market and the demand and supply on the global currency market.

Usually, developing countries, for stability, opt for a fixed exchange rate as the floating exchange rate can decrease the value of the currency.

Therefore, in a floating exchange rate regime, if the demand for the currency is high, the value will increase. On the contrary, if the demand is low, the value of the currency will decrease.

In a floating exchange rate regime, the ideal situation is when the inflow and outflow of foreign currency are somewhat equal.

If the inflow of foreign currency in a country is greater than the outflow, then the said country’s currency will be stronger and vise-versa.

A fixed exchange rate or pegged rate, on the other hand, is set against another major currency. A fixed exchange rate is set by the central bank.

In other words, a fixed exchange rate is known as a regime where a country ties the value of its currency to some other widely-used commodity or currency.

Usually, developing countries, for stability, opt for a fixed exchange rate as the floating exchange rate can decrease the value of the currency.

Countries, opting for a fixed rate, often peg their currency against the country’s currency with which most of the trade occurs.

Nepal’s history regarding exchange rates has seen a few interesting changes. Until 1957, Nepal’s currency was under the floating exchange rate system.

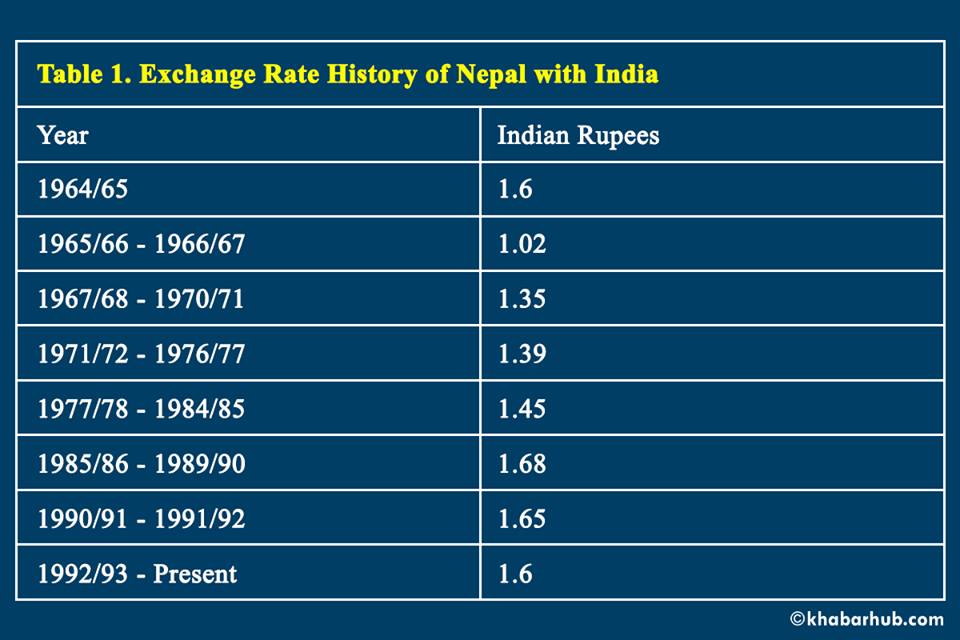

After the establishment of Nepal Rastra Bank in 1956, the currency was pegged with Indian Rupees at the rate of 100 NPR = 154.5 INR. Exchange rates between Nepali currency and Indian currency have gone through a few changes after that (Table 1).

There have been many changes in the last 25 years and “the debate on whether the peg is needed for Nepal “has been raised on many occasions. While most of the economists argue that peg is the reason for stability in the trade and stability of the Nepalese currency, some other economists here believe that Nepali currency shouldn’t remain pegged with Indian currency. Their argument is to make the country independent but at the same time, they suggest Nepali Rupee be pegged to the US dollar.

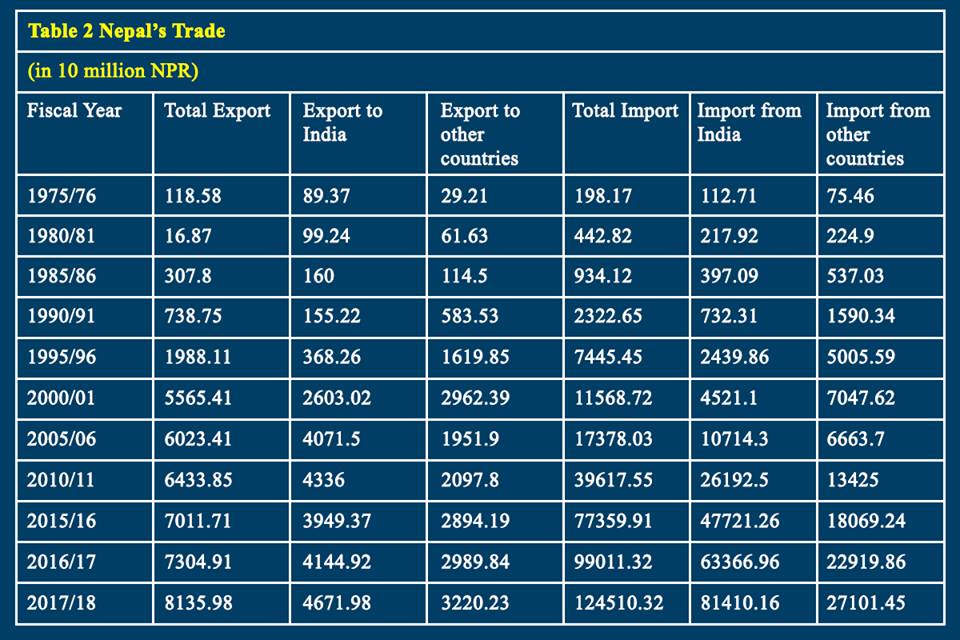

Pegging with US Dollar is not practical, even not possible at the current situation when Nepal’s largest trading partner is India (Table 2); hence until now, Nepal’s currency has been pegged with Indian currency.

Nepal does not have large exportable goods and Nepal’s leading trade partner is still India. As Nepal’s largest trading partner is India, and the Nepali currency is pegged with Indian currency, some Nepali citizens make a blanket statement that Nepal is highly dependent on India on all aspects.Nepal receives most of its imports from India. Keeping this rate of exchange stable removes all uncertainty, and provides a useful market indicator for the country.

These citizens also loosely mention that Not pegging with the Indian currency means reducing Nepal’s dependency on India — thinking if based on the political bias will be unfortunate.

So the next logical question is:

What could be the impact of removing the Peg with Indian Currency?

One of the most common views is to reduce imports from India, and/or change the exchange rate between Nepal and India from fixed to floating.

However, neither might be the best course of action for Nepal given the present situation of the country.

If the peg with Indian rupees is removed, Nepali rupees will face a severe decline because, in the case of Nepal, the outflow of foreign currency is higher than the inflow.

This means that all imports including from the rest of the world will become more expensive in Nepali rupees.

If the peg was not continued with India the value of 1 INR would be equal to 3.9 NPR (based on the same growth rate of 143.83%). However, this scenario is merely a hypothesis with assumptions.

If the exchange rate is changed from fixed to floating, given Nepal’s terms of trade in the international market, the exchange rate between Nepali currency and foreign currencies, could drastically increase, to Nepal’s disadvantage.

Hence a floating trade rate does not appear to be viable for Nepal at this moment.

In 1993 as mentioned above, Nepali Rupees were pegged with Indian currency at the rate of 1 INR = 1.6 NPR.

During the same period, 1 USD = 49.59 NPR. The current value of 1 USD is equal to 120.89 NPR (exchange rate between Nepal and the USA on June 28, 2020).

Let us assume that Nepal did not continue the peg with India in 1993, but instead opted for a floating exchange rate system. The growth rate of NPR to USD from 1993 to the present is 143.82%.

If the peg was not continued with India the value of 1 INR would be equal to 3.9 NPR (based on the same growth rate of 143.83%). However, this scenario is merely a hypothesis with assumptions.

Through this, we can observe that if Nepal removes the peg with India, then the value of Nepali currency would depreciate substantially.

As for reducing import dependency with India, Nepal’s production and manufacturing sectors have not been able to boom, therefore before reducing imports, increasing production and manufacturing in Nepal is of utmost importance.

Given Nepal’s poor and unfavorable policies to revitalize the industrial base and the agriculture sector, domestic production may not increase.

Some vital elements such as relaxation in taxes and customs duties, market guarantee, and subsidies for agriculture are still not granted by the government of Nepal and have not created an environment for removing the peg possible.

Alongside, businesses are facing difficulty to flourish as the shortest distance to the seaport from Kathmandu on average is 11 days (to and from) (Kolkata seaport).

So if the pegging is revised, then imports would be more expensive causing the burden to fall on the consumers. Additionally, Nepal’s number one import item is petroleum products which is a necessity.

Our View:

We feel that “Changing the fixed-rate between Nepal and India might not be the best strategy right now.”

(Co-authored by Swastik Aryal)

Comment