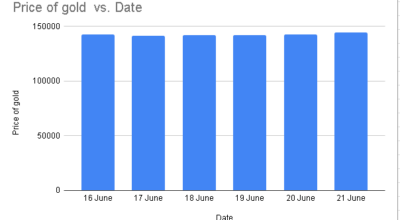

KATHMANDU: During the week of June 16th to 21st, 2024, gold prices in Nepal demonstrated stability amidst global economic uncertainties. Starting at Rs 142,800, prices fluctuated mildly, declining to Rs 141,200 early in the week before rebounding to Rs 144,700 by Friday.

These movements reflected sustained interest possibly driven by geopolitical tensions or economic data, highlighting gold’s role as a safe-haven asset during volatile times.

Meanwhile, Nepal’s stock market, represented by the Nepse index, showed a mixed performance, influenced by sectoral dynamics and external economic factors.

Additionally, Nepal’s fiscal landscape revealed challenges with a significant deficit, underscoring the need for careful fiscal management amidst rising expenditures.

On a positive note, Foreign Direct Investment surged to Rs 44.40 billion, driven by successful government initiatives to attract investment, particularly in small-scale industries and tourism.

Stable gold prices amid global economic volatility

Throughout the week of 16th to 21st June 2024, gold prices in the Nepali market experienced moderate fluctuations, maintaining overall stability amidst global economic uncertainties.

Starting at Rs 142,800 on Sunday, the price declined to Rs 141,200 on Monday, possibly reflecting profit-taking or market corrections. However, it rebounded to Rs 142,200 on Tuesday and held steady through Wednesday.

Thursday saw a return to Rs 142,800, indicating sustained interest possibly driven by geopolitical tensions or economic data. The week closed on a stronger note at Rs 144,700 on Friday, suggesting increased safe-haven demand amid global economic volatility.

This period underscored balanced supply-demand dynamics in Nepal, influenced by factors such as inflation concerns, central bank policies, and international market trends.

Meanwhile, on Sunday, the update on gold and silver prices from the Federation of Nepal Gold and Silver Dealers’ Association highlighted a significant decline in gold prices. According to their report, gold prices decreased by Rs 2,700 per tola, with rates standing at Rs 142,000 per tola for fine gold and Rs 141,300 per tola for standard gold on Sunday.

This marks a notable drop from Friday’s prices, when gold was priced higher at Rs 144,700 per tola and Rs 144,000 per tola respectively. Alongside this, the price of silver has been set at Rs 1,815 per tola.

These prices are determined daily based on international market rates, indicating that global factors are influencing local pricing trends in Nepal. It’s important to note that one tola equals 11.66 grams, providing clarity on the unit of measurement used in these market transactions.

Nepse index shows mixed performance

Throughout the trading week from 16th to 21st June 2024, the Nepse index exhibited a mixed performance, reflecting varied market sentiments and external economic influences.

Starting at 2095.25 on Sunday, the index experienced a decline of 17.04 points or -0.8%, settling at 2076.49 on Tuesday amid cautious trading. Wednesday saw a marginal recovery to 2078.76, with a slight increase of 2.27 points or 0.1%.

However, Thursday witnessed a downturn to 2068.31, marking a decrease of 10.44 points or -0.5% by the week’s end. The market dynamics were shaped by sectoral performances and external economic factors, including global market trends and local investor sentiment.

Nepal faces fiscal deficit as mid-June budget review reveals challenges

In mid-June, Nepal’s fiscal landscape was marked by a notable deficit, exacerbated by increased spending that saw the negative balance in the budget swell to Rs 181 billion, rising by Rs 23.70 billion in the recent review period. Government revenues totaled Rs 944.59 billion, consisting of Rs 829.03 billion from taxes, Rs 90.15 billion from non-tax sources, Rs 2.75 billion in grants, and Rs 22.65 billion borrowed.

Meanwhile, expenditures amounted to Rs 1.181 trillion, exceeding the previous year by Rs 3 billion.

This encompassed Rs 822.80 billion in recurrent expenses, Rs 134.97 billion in capital outlays, and Rs 223.50 billion for interest and debt repayments. Officials from the Financial Comptroller General Office cautioned that further expansion of the deficit could impede government disbursements, highlighting a remaining fiscal space of just Rs 5 billion for additional loans this fiscal year.

Nepal’s FDI soars to Rs 44.40 billion in FY 2023/24

Foreign Direct Investment (FDI) in Nepal has surged to Rs 44.40 billion by mid-June of FY 2023/24, marking a substantial increase from Rs 34.58 billion in the same period last year.

This rise is largely attributed to the success of the government’s investment summit, which has so far approved 359 proposals, including Rs 3 billion worth of FDI approvals in Jestha alone, expected to create 20,146 jobs this year.

Additionally, the automatic route for FDI has facilitated Rs 11.81 billion in investments through 90 proposals received. Nepal has now attracted nearly Rs 500 billion in FDI, with a particular focus on boosting small-scale industries and enhancing the tourism sector.

Tax Reform Committee proposes phasing out LPG subsidies

The high-level tax reform committee has proposed a phased removal of Liquefied Petroleum Gas (LPG) subsidies for citizens over three years due to substantial losses incurred by the Nepal Oil Corporation (NOC) in this sector.

In addition, the committee has recommended adjustments to household electricity tariffs aimed at encouraging greater use of hydropower and the complete elimination of current LPG subsidies. It has also suggested the introduction of green taxes on aviation fuel and an expansion of taxes on environmentally damaging coal imports.

Furthermore, the committee has advised implementing green taxes on goods previously subject to excise duties and promoting the establishment of waste recycling centers within industries to support a sustainable economy.

To facilitate these initiatives, the committee proposed offering tax incentives and other supportive measures.

Record high deposits in banking sector

The deposits in banks and financial institutions, including those from the general public, have reached Rs 6.265 trillion.

The surge in deposits in Nepal’s banking sector, coupled with stagnant loan demand, underscores a significant imbalance in the financial landscape. Despite increased government spending and the resulting liquidity influx, commercial banks, holding Rs 5.546 trillion of the total deposits, have not seen a corresponding rise in lending activity.

This surplus liquidity could exert downward pressure on interest rates, impacting banks’ profitability while reflecting cautious borrowing sentiment among businesses and consumers amidst economic uncertainties.

The Nepal Rastra Bank’s vigilance will be crucial in assessing whether targeted policy interventions are necessary to stimulate credit uptake and optimize the surplus liquidity for sustained economic growth.

Loan disbursement stands at Rs 5.135 trillion

The total loan disbursement by banks and financial institutions by mid-May was Rs 5.113 trillion.

The figure reveals a significant disparity between the amount of funds available for lending and the actual demand for loans in the economy. As of the latest update, banks and financial institutions have disbursed a substantial Rs 5.135 trillion in loans, with a notable portion coming from commercial banks alone.

Despite a credit-to-deposit ratio of 79.83 percent, indicating that banks have the capacity to lend more, loan demand has not increased. This stagnation is attributed to a sluggish economic environment, characterized by a lack of robust government spending and an overall tepid response from investors.

Foreign currency exchange rates

The Nepal Rastra Bank (NRB) has fixed the foreign currency exchange rates for Monday (June 24).

According to NRB, the buying rate of one US dollar has reached 133 rupees 36 paisa, and the selling rate has reached 133 rupees 96 paisa.

Similarly, the buying rate of one Euro is 142 rupees 60 paisa, and the selling rate is 143 rupees 24 paisa.

The buying rate of one British pound is 168 rupees 65 paise, and the selling rate is 169 rupees 41 paise.

According to Nepal Rastra Bank, the buying rate of one Qatari riyal is 36 rupees 58 paisa, and the selling rate is 36 rupees 74 paisa.

(Prepared by Srija Khanal)

Comment