0%

(Image for Representation)

KATHMANDU: Challenging the conservative speculations against women of being prodigal and spendthrift, and their male counterparts being thoughtful, practical and visionary, the latest statistics provided by Nepal Rastra Bank (NRB) shows that women, as in many other things, are better at saving than men.

Owing to the state’s attempts to empower women and the vision of NRB to make women financially independent, women have taken to the bank for their savings.

Citing that despite more interests in women’s special accounts, men surpass women in number in terms of the total bank accounts, NRB, the supreme regulatory body in monetary policy, has suggested various lucrative offers encouraging women in opening a bank account.

Efforts to attract more women for signing up for accounts have materialized as all sectors including government, development agencies, financial institutions and cooperatives are turning to financial empowerment that can be boosted with the account owner as a tool for poverty alleviation.

NRB data shows, there are 748 bank and financial institutions at 753 local levels. 61% Nepalis have their account in the financial institutions of A, B, and C grades. If grade D and the cooperatives are also included in the list the number of account holders reaches nearly 93%.

According to the latest NRB statistics, till Mid-January this year out of 93% Nepalis have got their accounts in banks or other financial institutions. Among those who have no account or unbanked so far, the majority are women, poorer adults living in remote areas and out of the workforce who have neither any knowledge about the benefits of such accounts nor have any access to it.

Out of total accounts, 78% are the saving accounts in which women have their hold on 30% whereas men have stronger dominance with ownership over 48% of the saving accounts.

NRB data shows, there are 748 bank and financial institutions at 753 local levels. 61% Nepalis have their account in the financial institutions of A, B, and C grades. If grade D and the cooperatives are also included in the list the number of account holders reaches nearly 93%.

Women more focused on saving

According to NRB, the savings account ownership in Nepal was 25% by women and 48% by men in FY 2018/19. The savings account ownership was 22% by women and 48% by men in FY 2017/18. This shows a remarkable change in women’s hold as men’s hold remained somehow the same in the last 3 years. Thus women are turning more conscious about saving than men lately.

Dr. Gunakar Bhatta, the spokesperson at Nepal Rastra Bank affirms the interpretation and says that women are saving more than before. “Provided people are told about the benefits people can get from financial awareness about the facilities people can entertain provided they take to banking or save in banks, more women are sure to be attracted towards it,” Bhatta said.

Bhatta hails the change in social structure, education, and culture of regarding domestic chores also as part of economic activities responsible for the growing saving habits.

“Various self-help schemes, skill-focused training, employment opportunities, and the financial activities revitalized by various financial institutions are also responsible for it,” Bhatta said to Khabarhub.

Lately, with the increase in the financial hold, the women are gaining popularity as successful entrepreneurs, leaders, high officials and record holders in various fields as well.

Financial institutions are also turning tempting job-hubs with the increase in success stories of women lately. It’s remarkable that out of the employees in 28 commercial banks, 40% are women.

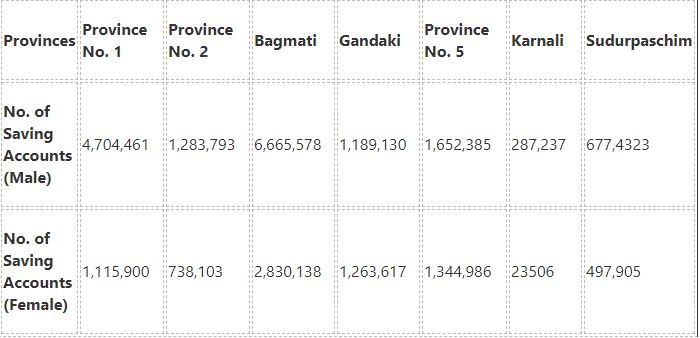

Status of saving accounts ownership in Nepal (Province-wise)

Source: NRB

As the table based on NRB data shows, Gandaki Province has the best account ownership status in the country as the number of accounts owned by women excels the ones owned by men though marginally.

Ironically, although Province No. 2 and Bagmati Province have the highest number of women employed abroad, the financial ownership there seems still under men’s grip. Although Province 2 seems backward in account ownership, the latest campaign targeting women’s bank account and mandatory education can make a substantive impact in the days to come.

Though with different names, Karnali and Sudur Paschim Province have also initiated some programs targeting girls’ education and women empowerment which can bring a remarkable change in the coming years.

Once the transition is over, the economic activities triggered by the cumulative efforts in various sectors ranging from the inclusion in all tiers of government, reservation in civil service and other services, priorities in entrepreneurship sector are sure to fare better future for women, their empowerment and nation as a whole.

Lastly, although the number of women having savings accounts seems low, considering the time the women started showing interest in financial status, it is a positive indication of the fact that though late, for now, the economic activities are likely to be triggered successfully in few years.